Beginners: How to Build Your Own Gold Trading Strategy

Unleash your inner gold trader! Craft a personalized gold trading strategy with our beginner-friendly guide. Learn key concepts, discover effective strategies, and unlock the potential of the precious metal market.

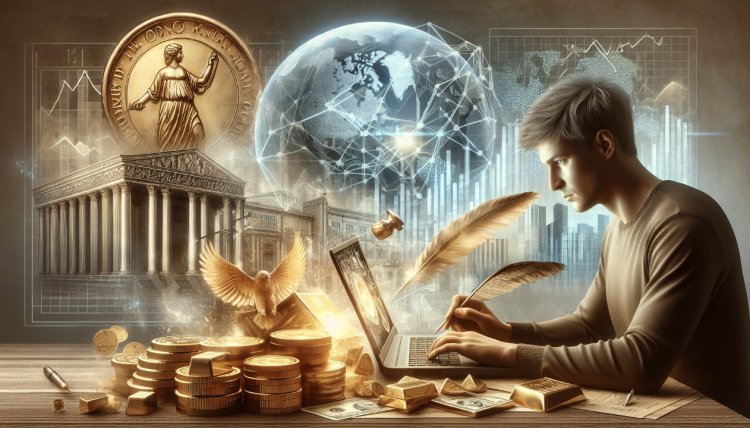

A Brief History of Gold

Gold has been traded since the dawn of civilization, with its use in Roman coins dating back to 30 BC. Throughout history, gold has played a significant role in various empires, including the British Empire and the United States. Nowadays, gold trading has evolved into online trading, allowing anyone with online access and money to potentially trade gold or its derivatives.

Creating Your Gold Trading Plan

When it comes to gold trading, it's crucial to have a well-defined trading plan. Here are the steps to creating your own gold trading strategy:

1. Analysing the Charts

The first step is to analyse the charts and determine the trend. Day traders can use shorter timeframes like the 5 and 30-minute charts, but it's essential to also look at the one-hour and daily charts to identify the larger trend. This analysis will help you decide whether to open a buy or sell position.

2. Determining Price Levels

The next part of planning your trade is to determine three different price levels:

-

The price at which you're willing to open the position

-

The level at which you plan to take profits

-

The level to set your stop losses

It's crucial to set these levels in advance to effectively manage the risk of your trade. To determine these levels, you can look at historical support and resistance levels or use trading indicators like Fibonacci retracements or moving averages.

Factors Affecting Gold Prices

Understanding the factors that cause gold prices to fluctuate is essential for successful gold trading. Here are some key factors to consider:

1. US Dollar

Gold is denominated in US dollars, so any rise or drop in the value of the dollar usually reflects in the price of gold. When the dollar falls, gold prices tend to increase as gold becomes relatively more expensive. Conversely, when the dollar rises, gold prices tend to decrease as gold becomes cheaper in dollar terms.

2. Interest Rates

Gold has a correlation with interest rates, particularly real interest rates. Gold prices tend to rise when interest rates go down, and they drop when interest rates rise. Real interest rates are calculated by subtracting the inflation rate from the nominal interest rate. Historically, gold prices have gone down when the real interest rate is below one percent. Monitoring the interest rates set by central banks, such as the Federal Reserve, can provide insights into potential buying and selling opportunities.

3. Central Banks

Central banks are significant players in the global gold market. When central banks buy more gold, it can cause the price to increase, at least in the short term. If gold prices subsequently form an uptrend, it could be a favourable opportunity to follow.

4. Gold Production and Mining Companies

The production of gold and the performance of gold mining companies have an impact on gold prices. Increasing demand and a rising price can incentivize gold mining companies to extract more gold. However, the remaining gold in the ground is limited and expensive to extract. Monitoring the stocks of gold mining companies can provide insights into the supply and demand dynamics of the precious metal.

5. News and Events

Major economic and political events often influence the price of gold. Events like armed conflicts, elections, referendums, and pandemics can push investors to buy or sell gold. Keeping an eye on significant events, especially those that surprise the markets, can be beneficial for gold traders.

Conclusion

Gold trading offers opportunities for investors and traders to profit from the fluctuating price of this precious metal. By analysing charts, determining price levels, and considering factors like the US dollar, interest rates, central bank actions, gold production, and news events, beginners can build their own gold trading strategy. Remember to always conduct thorough research and practice risk management to increase your chances of success in the gold trading market.

admin

admin