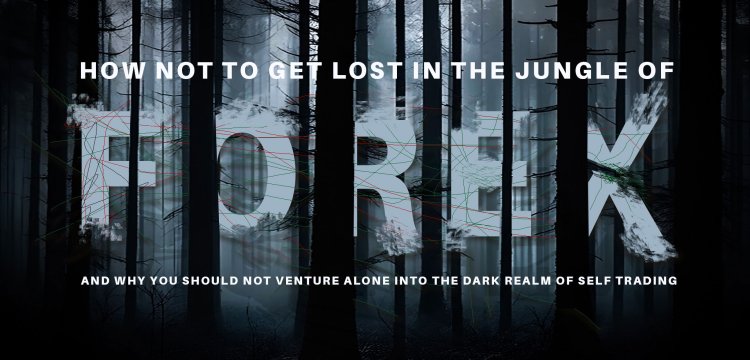

Why you should not self-trade forex: Do not venture into the dark realm of forex alone.

Discover the critical reasons behind 'Why You Should Not Self-Trade Forex: Do Not Venture into the Dark Realm of Forex Alone'. This insightful guide highlights the risks and challenges of navigating the complex world of forex trading without proper guidance or support. Learn about the pitfalls of self-trading and the importance of informed decision-making, expert advice, and strategic partnerships in the volatile forex market.

You should always start with the managed Forex accounts. If your broker is providing that, you can be sure that your broker is an STP broker and wants you to make profits.

The Power of Forex Trading

In the world of investment, forex trading stands out as a potentially lucrative yet highly volatile market. This dynamic arena revolves around the buying and selling of currencies, offering ample opportunities for financial gains. However, navigating the forex trading market demands a combination of caution and expertise to mitigate the inherent risks.

The term "forex" is derived from "foreign exchange," reflecting the global nature of this market where currencies are traded. As one of the largest and most liquid financial markets, forex trading presents an enticing prospect for investors seeking substantial returns. Nevertheless, the ever-changing landscape of currency values and exchange rates underscores the necessity for astute decision-making and risk management strategies.

Amidst the fluctuations and complexities of the forex market, investors are drawn to its potential rewards while recognizing the need for a prudent approach. The interplay between different currencies creates a dynamic environment that requires careful navigation to capitalize on profitable opportunities while safeguarding against potential pitfalls.

Risks in Forex Trading

The world of forex trading is not without its risks, and investors must be aware of the potential challenges they may encounter. Understanding these risks is essential for making informed decisions in the volatile forex market.

Market Volatility

-

The forex market is renowned for its high volatility, which is characterized by rapid and unpredictable price movements. This volatility can create an environment of uncertainty, making it challenging for traders to predict market trends accurately.

Financial Losses

-

Inexperienced traders often face significant financial losses due to the market's unpredictable nature. The dynamic shifts in currency values and exchange rates can lead to unexpected downturns, impacting the profitability of trades.

Navigating the forex market requires a thorough understanding of these risks and the implementation of effective risk management strategies to mitigate potential losses. By acknowledging the uncertainties associated with currency trading, investors can approach the market with caution and preparedness.

Self-Trading Temptation

Many individuals find themselves drawn to the allure of self-trading, enticed by the potential for substantial profits. Despite lacking the necessary expertise, they are tempted by the prospect of taking their financial matters into their own hands. The appeal of personal trading lies in the perceived autonomy and control it offers over investment decisions. However, this temptation often leads to unforeseen challenges and risks.

Lack of expertise

-

Engaging in self-trading without the requisite expertise can prove to be a daunting endeavor. Without a comprehensive understanding of market dynamics, trend analysis, and risk management strategies, individuals may find themselves navigating unfamiliar territory with limited preparation. This lack of expertise can significantly heighten the vulnerability of self-traders to market fluctuations and unexpected developments.

Emotional decision-making

-

Self-traders are susceptible to making impulsive decisions driven by emotions rather than sound judgment. The absence of a professional framework for decision-making can lead to erratic choices influenced by fear, greed, or uncertainty. Emotional decision-making often results in suboptimal outcomes and can amplify the impact of market volatility on individual trades.

In essence, while the idea of self-trading may hold appeal for some investors seeking independence in their financial pursuits, it is essential to recognize the potential pitfalls associated with this approach. Without the guidance and expertise offered by professional management, self-traders may find themselves navigating turbulent waters without a clear path forward.

Forex Market Volatility

In the realm of forex trading, market volatility is a defining characteristic that significantly influences the dynamics of currency exchange. The foreign exchange market is renowned for its inherent unpredictability, creating an environment where rapid and unforeseen price movements are commonplace. This unpredictability poses a considerable challenge for individual traders seeking to navigate the currency market effectively.

Unpredictable Nature

The forex market's unpredictable nature stems from a myriad of factors, including geopolitical events, economic indicators, and global financial developments. These variables contribute to an environment where currency values can experience sudden fluctuations without warning. As a result, traders often find themselves grappling with the complexities of an ever-changing landscape, requiring agility and astuteness to capitalize on potential opportunities while safeguarding against risks.

Impact on Trades

The impact of market volatility on trades within the forex market cannot be overstated. For self-traders in particular, the unpredictability of currency values and exchange rates can lead to significant challenges in achieving successful outcomes. Sudden price movements driven by market volatility have the potential to disrupt trade positions and expose individuals to unexpected losses. Consequently, self-traders must contend with the reality that their financial decisions are subject to the influence of external forces beyond their control.

In essence, the unpredictable nature of the forex market exerts a profound influence on individual trades, necessitating a strategic approach to risk management and decision-making. By acknowledging and addressing the implications of market volatility, traders can adopt measures to mitigate its impact and enhance their resilience in navigating this dynamic landscape.

Managed forex accounts

A Safer Approach to Forex Trading

In the realm of forex trading, managed forex accounts emerge as a compelling alternative for investors seeking professional oversight and risk mitigation. This approach offers a shield against the potential pitfalls of self-trading while leveraging the expertise of seasoned professionals in navigating the dynamic landscape of currency exchange.

Professional Management

Managed forex accounts provide investors with access to professional management by experienced traders who specialize in forex portfolio management. This professional oversight encompasses strategic decision-making, market analysis, and trade execution, offering a level of expertise that is often beyond the reach of individual traders. By entrusting their investments to seasoned professionals, investors can benefit from a comprehensive approach that aims to optimize returns while minimizing risks.

Risk Mitigation

One of the key advantages of managed forex accounts lies in their ability to mitigate the risks associated with individual trading. The experienced professionals overseeing these accounts implement robust risk management strategies designed to safeguard investments against market volatility and unexpected downturns. Through diversification and proactive risk assessment, managed forex accounts provide a safer investment environment, offering stability and security in an otherwise volatile market.

By embracing managed forex accounts, investors gain access to a professional framework that aims to maximize returns while mitigating risks, providing a compelling alternative to self-trading's inherent uncertainties.

Advantages of Managed Accounts

Expertise and experience

When investors opt for managed forex accounts, they gain access to the expertise and experience of professional traders. These seasoned professionals bring a wealth of knowledge and insights into the intricacies of the forex market, allowing them to make informed decisions that align with the investment goals of their clients. By leveraging the expertise and experience of these professionals, investors can enhance their potential for success in the dynamic world of currency trading.

Moreover, the professional traders overseeing managed forex accounts are well-versed in market analysis, trend identification, and strategic trade execution. Their depth of experience enables them to navigate complex market conditions with agility and precision, optimizing the performance of investment portfolios. This level of expertise offers a distinct advantage over individual traders, who may lack the comprehensive understanding required to capitalize on lucrative opportunities while mitigating risks effectively.

Diversification and risk management

Managed accounts present investors with an opportunity for diversification and effective risk management strategies. Through a carefully curated portfolio of currency investments, managed forex accounts aim to spread risk across various currency pairs, reducing exposure to volatility in any single market. This diversification strategy serves as a protective measure against unforeseen downturns or adverse movements in specific currencies, contributing to overall portfolio stability.

Furthermore, professional managers overseeing these accounts implement robust risk management techniques designed to safeguard investments against market fluctuations. By conducting thorough risk assessments and proactive monitoring of market conditions, they can swiftly respond to potential threats and take preventive measures to mitigate risks effectively. The combination of diversification and proactive risk management provides investors with a secure investment environment within the forex market.

TradeFxP for Managed Accounts

Reliable Platform

TradeFxP offers a state-of-the-art platform tailored to meet the needs of investors utilizing managed forex accounts. The platform is designed with a focus on reliability, providing a robust infrastructure that ensures seamless and secure transactions. By leveraging advanced technology and stringent security measures, TradeFxP prioritizes the protection of investors' assets while facilitating efficient trade execution.

The user-friendly interface of the TradeFxP platform enhances accessibility for investors, allowing them to monitor their managed accounts, track performance metrics, and stay informed about market developments in real time. This transparency fosters a sense of confidence and empowerment among investors, enabling them to make well-informed decisions based on comprehensive insights into their investment portfolios.

Moreover, TradeFxP's reliable platform incorporates cutting-edge tools and analytics that equip investors with the resources needed to assess market trends, analyze trade performance, and gain valuable perspectives from seasoned professionals. This integration of innovative features empowers investors to take an active role in their investment journey while benefiting from the expertise provided by managed forex accounts.

In essence, TradeFxP's commitment to offering a reliable platform underscores its dedication to creating a conducive environment for investors utilizing managed forex accounts. The platform's resilience and intuitive functionality serve as pillars of support for investors seeking stability and security in their forex trading endeavors.

Professional Support

At TradeFxP, professional support is at the core of the experience offered to investors leveraging managed forex accounts. The platform provides access to a team of experienced professionals who offer guidance, insights, and strategic counsel tailored to individual investment objectives. This personalized approach ensures that investors receive comprehensive support throughout their forex trading journey, fostering a collaborative partnership focused on achieving financial goals.

The professional support provided by TradeFxP extends beyond transactional assistance to encompass educational resources aimed at enhancing investors' understanding of forex markets and investment strategies. Through webinars, tutorials, and expert insights, investors can deepen their knowledge base and refine their decision-making processes under the guidance of seasoned professionals.

Furthermore, TradeFxP's commitment to professional support manifests in its proactive approach to addressing investor queries or concerns promptly. By facilitating open lines of communication and offering responsive assistance, the platform cultivates a supportive ecosystem where investors feel valued and empowered in their financial pursuits.

Securing Investments

Risk Protection

When it comes to securing investments, managed forex accounts play a pivotal role in providing a protective shield against the inherent risks associated with individual trading. By entrusting their funds to experienced professionals, investors gain access to a robust risk management framework that aims to safeguard their capital from potential downturns and market uncertainties.

The professional managers overseeing managed forex accounts are adept at implementing proactive risk mitigation strategies. Through diligent monitoring of market conditions and swift responses to emerging threats, these experts strive to shield investors from the adverse impacts of market volatility. This proactive approach serves as a bulwark against unforeseen developments, offering a sense of security and stability for investment portfolios.

Furthermore, the diversification strategies employed within managed forex accounts contribute significantly to risk protection. By spreading investments across various currency pairs and markets, these accounts reduce the exposure to volatility in any single market, thereby enhancing overall portfolio resilience. This diversification acts as a buffer against sudden fluctuations in currency values, fortifying the stability of investors' assets.

In essence, the risk protection offered by managed forex accounts reflects a commitment to preserving investment security amidst the dynamic landscape of currency trading.

Stable Returns

Investors seeking stable returns and reduced exposure to market volatility find an appealing proposition in managed forex accounts. These accounts are designed to optimize performance while minimizing risks, culminating in consistent returns for investors over time. The expertise and experience of professional traders overseeing these accounts enable them to navigate market fluctuations with agility, positioning investment portfolios for sustained growth.

Moreover, the strategic decision-making inherent in managed forex accounts contributes to stable returns for investors. The seasoned professionals at the helm of these accounts leverage their insights into market trends and trade execution strategies to capitalize on lucrative opportunities while mitigating risks effectively. This approach fosters an environment where investors can expect reliable returns without succumbing to the uncertainties often associated with individual trading endeavors.

By embracing managed forex accounts, investors not only protect their investments but also position themselves for long-term financial security through stable returns that transcend the volatile nature of the forex market.

Professional Approach in Forex

In the realm of forex trading, a professional approach is crucial for navigating the complexities of the market and optimising investment outcomes. Managed forex accounts offer investors access to expert forex management, ensuring a level of professionalism that enhances their trading experience.

Experienced Management

-

The expertise of seasoned professionals is a hallmark of managed Forex accounts, providing investors with a level of insight and strategic acumen that goes beyond individual trading endeavors. These experienced managers bring a wealth of knowledge and a comprehensive understanding of market dynamics, allowing them to make informed decisions that align with the investment goals of their clients.

Strategic Decision-Making

-

Professional management in forex trading involves the implementation of professional forex strategies aimed at optimizing the potential for success. By leveraging their expertise and insights into market trends, professional managers can execute strategic decision-making processes that position investment portfolios for sustained growth and stability. This strategic approach fosters an environment where investors can expect reliable returns without succumbing to the uncertainties often associated with self-trading.

A professional approach to forex not only provides stability but also offers investors an opportunity to benefit from the collective wisdom and expertise of seasoned professionals who are dedicated to maximizing returns while minimizing risks.

Seeking Stability in Forex

Seeking stability in forex is a paramount goal for investors navigating the dynamic landscape of currency trading. The allure of consistent returns and long-term financial security in forex underpins the pursuit of stability, prompting investors to explore avenues that offer resilience amidst market fluctuations.

Minimising Risks

Minimizing risks is a fundamental objective within the realm of forex trading, and managed forex accounts serve as a strategic mechanism for achieving this goal. By leveraging professional management and robust risk mitigation strategies, these accounts aim to shield investments from the inherent uncertainties of the forex market. The implementation of diversification techniques and proactive risk assessment contributes to a stable investment environment, minimizing exposure to potential downturns and unexpected market developments.

Furthermore, the expertise of seasoned professionals overseeing managed forex accounts enables them to navigate market volatility with agility, positioning investment portfolios for sustained growth while mitigating risks effectively. This approach fosters an environment where investors can expect reliable returns without succumbing to the uncertainties often associated with individual trading endeavors.

Long-Term Security

Investors seek stability in forex through managed accounts, not only for immediate gains but also with an eye toward long-term financial security. The commitment to long-term stability underscores the desire for consistent returns that transcend the volatile nature of currency trading. Managed forex accounts provide a secure investment environment that aligns with investors' aspirations for sustained growth and enduring financial well-being.

In essence, pursuing stability in currency trading reflects a strategic mindset focused on fortifying investments against market volatility while laying the foundation for long-term security and consistent returns.

The Future with Forex Trading

As we look ahead to the future of forex trading, it becomes increasingly evident that managed forex accounts represent a pivotal shift towards a safer and more secure approach in the realm of currency trading. The inherent volatility and complexities of the forex market necessitate a professional management framework that can provide stability and resilience for investors.

Managed Forex Accounts offer a compelling alternative to self-trading by leveraging the expertise of seasoned professionals in navigating the dynamic landscape of currency exchange. This approach not only mitigates risks but also fosters an environment where strategic decision-making and risk management strategies are at the forefront, optimizing the potential for success.

admin

admin