Choosing an Honest Forex Broker

Ensure secure trades by choosing an honest Forex broker. Uncover the key aspects to look for, avoid scams, and optimize your trading success.

Choosing an Honest Forex Broker

Forex brokers help traders to be connected to the financial market. They connect forex traders to interbank liquidity and other related areas to trade. Select a trustworthy forex broker to protect your money. While picking a forex broker, consider rules, deposit/withdrawal options, trading platforms, customer support, and transparency. Every forex trader requires a reliable broker. Honest forex brokers won't scam you. Regulated forex brokers are honest. Regulators monitor brokers for honesty and best practices.

An honest forex trading broker is also transparent. Good forex brokers would gladly discuss their services and costs. Compare broker prices beforehand. Even while pricing is obvious, beware of unrealistic and forceful marketing, phony reviews, and other scams. Honest forex brokers make trading profitable.

Consider how forex brokers serve clients. Traders need trustworthy, customer-focused brokers. Good customer service fixes issues swiftly. When choosing a broker, ask other traders about customer service. Finally, consider regulation, transparency, and customer service when choosing a reliable forex broker.

Criteria for Selecting an Honest Forex Broker

Forex trading is lucrative. Forex brokers must be trustworthy. Secure, fast, and insightful forex brokers. Unreliable brokers squander time, money, and effort. Hence, while picking a forex broker, examine fraud indicators. Licensed forex firms are best. Pick a reputable forex broker. Follow the National Futures Association, Financial Conduct Authority, and Australian Securities and Investments Commission. These certifications verify the broker's transparency, security, and compliance.

Second, forex broker fees. Investors must consider forex broker fees. Each forex trade has a spread or cost. Compare broker spreads. Check forex account maintenance and deposit/withdrawal fees.

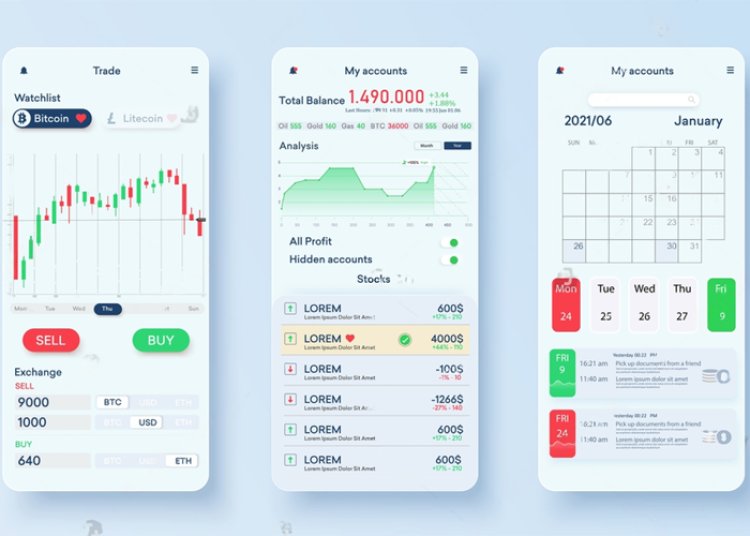

Trading platforms determine an honest forex broker. A reputable forex broker will provide a fast, easy-to-use trading interface. The platform should provide safe graphs, stop-loss, take-profit, and market orders. It needs real-time quotes and mobile trading. Hence, before picking a forex broker, make sure their platform meets your trading needs.

Transparency in Forex Brokerage

Forex brokers enable trade. Forex brokers are many, making selection tough. Select a transparent forex broker. Brokers must provide all service details to clients. Transparency helps forex traders understand costs and risks. Transparent brokers reveal spreads, fees, and trading expenses. Budgeting and broker selection would be easier. Transparent brokers should provide legal papers and explain limits and restrictions when opening accounts.

Forex brokerage transparency inspires trust. Forex brokerage demands trust like any business collaboration. Brokers need consumers' trust and faith. Trade history and financial disclosures build client trust. To ensure fairness and transparency, a forex broker should provide consumers with a third-party regulator or dispute resolution system.

Forex dealers must disclose. Transparent brokers disclose costs and risks. Updates and third-party regulator access build trust. Choose a trustworthy forex broker to trade profitably.

Effective Communication with Forex Broker

Forex trading requires a reliable broker. Forex trading involves broker trust, risk management, and profit maximization. The volatile forex market requires a trustworthy and communicative broker. As a forex trading student, you must understand how broker communication may help you achieve this.

Good communication is needed to trust and work with a forex broker. Forex trading requires communication; thus a reliable broker should prioritize customer communication. Brokers should hear traders' concerns and goals. Discuss. The broker should also provide market trends, risks, opportunities, and trading rules changes.

An honest forex broker will help traders establish a trading plan that meets their goals, risk appetite, and budget. Broker communication aids traders in risk assessment and decision-making. Forex brokers should offer webinars, e-books, and demos to teach trading. Brokers help traders decrease risks and boost profits.

Forex brokers must communicate well. Traders need a reliable, communicative broker. Regular, thorough updates, education, and tools from the broker help traders succeed. Broker-trader contact boosts confidence, lowers risks, and maximizes earnings. These factors are crucial when choosing a forex broker for students.

Ethical Practices in Forex Brokerage

Your forex broker affects performance. Unscrupulous forex brokers may hurt clients. Finding a reliable forex broker is essential. Ethical forex brokers are essential. This involves broker ethics and transparency. Hidden fees, manipulative markets, and trade reporting are unethical. Ethical forex brokers will disclose charges, not influence markets, and provide accurate trading records.

Ethical forex brokers boost trading. You'll feel safe investing with a business that has your best interests at heart. Ethical brokers have better relationships with financial regulators, reducing the risk of quick closure for illegal activity.

Forex dealers must be ethical. Honest brokers help and enlighten investors. Customer feedback and regulatory monitoring help you pick a broker. Trust an ethical forex broker.

To read more interesting articles CLICK HERE

Why do you need to be with TradeFxP? CLICK HERE

To join our Hunter AutoBot Trading Program CLICK HERE

All About TradeFxP's Hunter Ai EA Autobot CLICK HERE

admin

admin