Become a Successful Forex Trader with These Simple Steps

Learn how to become a successful forex trader with these simple steps. Discover effective strategies and tips for profitable trading. Start today!

Forex trading is a great way for people to build wealth for themselves. However, it can also be risky and often complicated. Many aspects should be considered before you decide to trade.

This is a list of tips that can help you make the transition from being a patient to taking a more active role in your healthcare.

Forex Market Trading requires a few key considerations. The first thing is to always keep your risk in mind. Make sure not to risk more than you can afford to lose as this could lead to major financial problems down the road.

A good trading strategy will help you stay on track and stop you from making impulsive decisions that might cost you more in the long run. Stick to your plan so your choices are always deliberate.

Don't be afraid to take some losses. Even the most successful people suffer losses now and again. Accept that they're a part of trading, and you'll find it easier to stay calm and focused if things don't go your way.

The only way you can ever hope to trade successfully is by starting with a well-constructed trading plan.

Before you trade in the forex market, you first need to formulate a trading plan. Goals and a plan for achieving them should be outlined here. It should also mention the risks associated with trading in forex.

An effective plan is the foundation of any successful trade. Plans help you make informed decisions and manage risk. It's important to review your plan regularly and make adjustments as needed.

Managing estimates

One of the key things to keep in mind for forex trading is how much risk you are taking on. This information will help you decide if you are making any money from your trades, and also how much profit you are generating overall.

Income and expenses can be measured in a few ways. One way is by analyzing your account balance. Your account balance will show you how much money is in your account and how much profit or loss you have made over time.

You should also obsessively monitor your profit and loss statement, or P&L. This will show you all of the trades you've made, as well as how much you profited or lost from each one. You can also see what your overall profit or loss on the day was.

You can look at the equity curve, which shows you the trend of your account balance over time. If it's going up, then you're doing well. However, if it's going down, then you need to take a closer look at your trading strategy.

Monitoring your progress can tell you if you're on the right track or not. If things are going well, then continue to do what you're doing. However, if things are going poorly, then it's time to make some changes.

Many factors affect the price of a currency pair's value. Irregularities in the Forex market can make it difficult to predict exactly how an exchange rate will change, such as whether there will be inflation or deflation.

For Forex traders to be successful and sustain their success, they must understand how resistance and support points work. Resistance points are thought to be those prices at which demand for a currency is strong enough to stop the price from falling even further. The opposite is true of support points- those prices where demand for a currency is thought to be strong enough to stop the price from rising even higher.

A technique that can be used to identify support and resistance points is the Fibonacci analysis. The technique is based on the Fibonacci sequence, which has been found to have many applications in nature, including in the financial markets.

Fibonacci analysis is typically used to identify potential reversals in the market, as this is where Fibonacci levels often coincide with a change in the trend of the market.

Once you've identified potential resistance or support levels with Fibonacci analysis, you should investigate as many other indicators as possible before deciding to buy. These might include candlestick patterns and moving average crossover signals.

With advanced features and currency trading tips, traders can plan for the future.

Plan ahead.

What are your goals?

Forex traders should formulate a trading plan before they start trading. This will outline your strategy, including how you'll approach the market, what you hope to achieve, and what your risk management rules are. Any strategy you choose will be difficult to stick to without a plan. So, this is an important step that should not be overlooked.

1 Research your topic:

Research and educate yourself before trading. There is a lot of information available from various sources, so take the time to learn as much as you can before you place any trades.

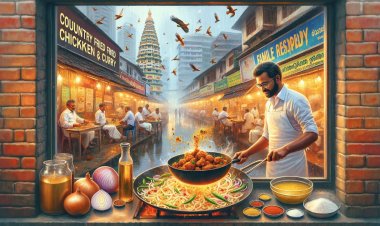

3. Choose an STP Broker:

One of the most important decisions you'll make when trading Forex is which broker to choose. It's important to find a trusted broker with good customer service and spreads that are tight enough for you. You should also think about what forex account type will work best for you and the minimum deposit required by each broker before making your choice. Once you've found a great broker, go ahead and open up a demo account and practice trading Forex with virtual currency before putting any real money at risk.

Start small and see what works.

When you're starting to trade currencies, it's best to focus on one or two currency pairs. Keeping your focus is important when you're trading.

Investors and traders

There are three types of traders in the world of forex: speculators, hedgers, and arbitrageurs.

Speculative traders are the riskiest and typically bet on currency pairs' direction. They purchase and sell currencies to earn profits. The main goal of a hedging market trader is to protect their investments from currency fluctuations. They do this by taking out two positions on the same currency pair - like if they think the EUR/USD will decrease, they will sell the pair.

For example, if EUR/USD is trading at different prices on two exchanges, an arbitrage trader will buy on the exchange where it's cheaper and sell on the more expensive exchange, profiting from the difference.

Pip - what is it?

The smallest unit of currency trading is the pip or percentage in point. In forex trading, a pip is typically worth 0.0001 of a currency unit but the value can vary with currency pairs. For example, if you're trading EUR/USD, each pip would be worth $0.0001 since one US dollar is worth approximately 0.74 euros.

What is a Lot?

Traders do not use the word 'lot' to measure one item, but rather it is a common unit of measure in trading. There are 100,000 units in a lot. For example, if you're trading EUR/USD, a standard lot could be valued at 100,000 euros.

What is leverage?

The margin is the ratio of how much currency you can trade, compared to how much money you have in your account. If you have $1,000 in your account and are using a 50:1 margin, you can trade up to $50,000.

What can we do for you?

Admit it, you are tired of trading. It's over with all the losses. We can help you in the following ways. Let us relieve you of the burden. No more stress, No more fatigue. No more anxiety. No more anticipation. No more worries. No more losses. No more of anything bad. My dear friend, if anyone tells you money cannot buy happiness, that person either doesn't have it or is bonkers. Hello, you are about to hit 2023.

Wake up...

All you need to do is open up a live trading account with us and connect it to our HUNTER Ai Autobot which is supervised round the clock by our in-house market veterans. Almost seven years have been spent testing this Ai EA.

Parameters

· The account is totally under your control.

· You decide when to stop and withdraw.

· Passwords and fund transfers are not required by us from you.

· All processes are automated.

· It is simply the Ai machine trading instead of you.

· All you have to do is simply sit back and watch your account grow.

Your benefits...

There are plenty of benefits. But to be short you have all the time and peace of mind along with financial freedom to do all the things you love. Be it being with your loved ones or partying all night, the possibilities are endless.

Why?

Because we are a pure STP broker. Only if our clients make money, we do make money from the liquidity providers. The more you win, we win too.

How to join?

Just CLICK HERE.

admin

admin