The Dark Side of Offshore Wealth: Corrupt Elites and Money Laundering

Sun-kissed islands, hidden accounts, dirty secrets. Dive into the murky depths of offshore wealth, where corrupt elites stash cash and launder ill-gotten gains. Unmask the sinister reality behind tax havens and expose the human cost of financial shadows.

Introduction

Disclaimer: The views expressed in this blog post are those of the author and do not necessarily reflect those of the creators of the documentary. "When plunder becomes a way of life for a group of men in a society, over time they create for themselves a legal system that authorizes it and a moral code that glorifies it." Frédéric Bastiat

In this transcript, we will explore the dark side of offshore wealth and money laundering, focusing on the Kenyatta, Aliyev, and Sharif families. Offshore wealth and money laundering are global issues that have a significant impact on developing economies and the global financial system. Understanding these issues is crucial for exposing corruption and advocating for transparency in financial transactions.

Offshore wealth refers to the practice of individuals and businesses moving their assets and finances to offshore tax havens, where they can take advantage of low tax rates, secrecy laws, and lax regulations. Money laundering, on the other hand, involves the process of making illegally gained proceeds appear legal by disguising their true origin.

The focus on the Kenyatta, Aliyev, and Sharif families is to shed light on how corrupt elites and their families have amassed significant wealth beyond their official sources of income. These families have become symbols of wealth and power in their respective countries, raising questions about the legitimacy of their wealth and the methods used to acquire it.

Jomo Kenyatta, the first President of Kenya, is believed to have acquired substantial wealth through questionable means, including the misappropriation of land. His son, Uhuru Kenyatta, the current President of Kenya, has also faced allegations of corruption and offshore investments. Through their control of the nation's oil and gas industry, the Aliyev family in Azerbaijan, headed by Heydar Aliyev and his son Ilham Aliyev, has amassed a sizable fortune. Similar to this, the Nawaz Sharif-led Sharif family in Pakistan has been associated with corruption scandals and accusations of money laundering.

These cases highlight the need for stronger regulations, transparency, and international cooperation to combat offshore wealth and money laundering. By understanding the extent of these issues and their impact on developing economies, we can work towards creating a more equitable and accountable financial system.

The Kenyatta Family: From Independence to Offshore Wealth

Since Kenya gained independence in 1963, the Kenyatta family has been a powerful and influential force in the country. Jomo Kenyatta, the first President of Kenya, played a crucial role in shaping the nation's future. However, questions have been raised about the origin of the family's wealth and their involvement in offshore investments.

Allegations of misappropriation of land and dubious methods of wealth accumulation accompanied Jomo Kenyatta's rise to power. Following Kenya's independence, the Kenyatta family allegedly diverted government funds intended for land redistribution to indigenous communities to buy prime land for themselves. This land acquisition has contributed significantly to the family's current wealth and influence, with the Kenyatta family being the largest landowner in Kenya, owning over 200 million hectares of land.

In addition to land acquisition, the Kenyatta family has also been involved in offshore investments and the use of offshore structures to hide their assets. The recent revelation in the Pandora Papers showed that President Uhuru Kenyatta and six members of his family were linked to 13 offshore companies. These offshore structures have raised questions about the transparency and legitimacy of the family's wealth.

The president's involvement in offshore structures raises concerns about the accountability and transparency of the country's leadership. Despite President Uhuru Kenyatta's claims of fighting corruption and promoting transparency, his offshore investments and the use of offshore structures contradict these statements.

The Kenyatta family's wealth and influence have significant implications for Kenya's economy and its people. The concentration of wealth in the hands of a few families, especially those with political connections, perpetuates inequality and widens the wealth gap in the country. This disparity is evident in the fact that two-thirds of the Kenyan population lives on less than $3.20 per day, while the Kenyatta family enjoys immense wealth and resources.

In conclusion, the rise of the Kenyatta family from independence to offshore wealth raises questions about the origin of their wealth and the methods used to acquire it. Land acquisition and involvement in offshore investments have played a significant role in the family's current wealth and influence. The president's involvement in offshore structures also raises concerns about transparency and accountability. Addressing these issues requires stronger regulations, transparency, and international cooperation to combat offshore wealth and money laundering.

The Aliyev Family: Oil, Power, and Hidden Assets

The Aliyev family's ascent to power in Azerbaijan began in 1993, when Heydar Aliyev, a former KGB general and secretary general of the Republic of Azerbaijan, orchestrated a coup. Since then, Heydar's son, Ilham Aliyev, has remained in power, serving as the country's president without interruption.

Azerbaijan is one of the largest producers of crude oil and natural gas, and the Aliyev family has built a vast fortune through their control of the country's oil and gas industry. However, allegations of corruption and money laundering have long plagued the family, raising questions about the legitimacy of their wealth and the methods used to acquire it.

One controversial aspect of the Aliyev regime is BP's alleged involvement in their rise to power. BP, the largest foreign oil company in Azerbaijan, has faced accusations of colluding with the Aliyev family and even assisting in their coup. While the exact details of any secret agreements between BP and the Aliyevs remain undisclosed, the close relationship between the two parties has raised eyebrows.

The Aliyev family's extensive business empire and offshore connections have further fueled speculation about their wealth. They control the largest banks in Azerbaijan, own a major private transportation company, and have a significant stake in the country's hotel industry. The family has also been linked to numerous offshore companies, using these structures to obscure the true extent of their assets.

The recent release of the Pandora Papers shed further light on the Aliyev family's hidden assets. The leaked documents revealed an extensive real estate empire in London, estimated to be worth $700 million, amassed through offshore companies associated with the family. One property, located on Conduit Street, was initially purchased by a company linked to a close associate of the Aliyev presidency before being sold to the president's 19-year-old daughter, Aarzo Aliyev, and later sold again to the Crown Estate, a company owned by Queen Elizabeth II.

Despite the revelations of the Pandora Papers and ongoing allegations of corruption and money laundering, there has been a lack of investigation by British authorities into the Aliyev family's offshore connections and hidden assets. The UK has been a favoured destination for individuals seeking to hide their ill-gotten wealth, and the case of the Aliyev family highlights the need for stronger regulations and enforcement to combat offshore wealth and money laundering.

The Sharif Family: Political Power and Financial Manipulation

The Sharif family, under the leadership of Nawaz Sharif, has a long history of involvement in Pakistani politics and has been the target of numerous allegations of financial manipulation and corruption. Nawaz Sharif's privatisation policies, which have drawn criticism for favouring his own family and associates, have been a defining feature of his political career.

Accusations of corruption and money laundering have haunted the Sharif family for years. They have been accused of misusing government funds and engaging in questionable business practices, including the misappropriation of land and the acquisition of assets beyond their official sources of income.

The Panama Papers scandal in 2016 shed further light on the family's offshore assets and raised questions about the transparency and legitimacy of their wealth. The leaked documents revealed that Nawaz Sharif and his family were linked to offshore companies and undisclosed assets, including luxury properties in London.

Despite the revelations and ongoing legal battles, the Sharif family has managed to evade accountability. The lack of transparency and accountability within the Pakistani legal system has allowed the family to maintain their political power and continue their financial manipulation.

London has played a significant role in the Sharif family's financial activities. The city has long been a haven for illicit wealth, attracting individuals and families looking to hide their ill-gotten gains. The family's extensive offshore connections and investments in London have allowed them to shelter their assets and avoid scrutiny.

The Sharif family's political power and financial manipulation have had far-reaching implications for Pakistan. The concentration of wealth and the lack of transparency in their financial dealings perpetuate inequality and hinder the country's development. The ongoing legal battles and lack of accountability only serve to undermine public trust in the government and the justice system.

Addressing the issue of political power and financial manipulation requires stronger regulations, transparency, and international cooperation. It is essential to hold corrupt elites accountable and create a more equitable and transparent financial system. Only by exposing and combating offshore wealth and money laundering can we work towards a more just and equitable society.

Western Complicity: The Role of the UK and Offshore Territories

Western countries, including the UK and its offshore territories, have played a significant role in facilitating the flow of illicit wealth and money laundering. The attractiveness of the UK as a destination for illicit wealth, criticism of the UK's response to money laundering, the limitations of the Economic Crime Act, challenges in identifying and seizing illicit assets, and the issue of two-tiered justice and Western hypocrisy are all key talking points in this regard.

The Attractiveness of the UK as a Destination for Illicit Wealth

The UK has long been a favoured destination for individuals seeking to hide their illicit wealth. Its reputation as a global financial hub, coupled with the availability of offshore territories like the Cayman Islands, British Virgin Islands, and Jersey, has made it an attractive location for money laundering. The ease of setting up anonymous companies, lax regulations, and a lack of transparency have allowed corrupt elites to transfer and hide their assets in the UK.

Criticism of the UK's Response to Money Laundering

Despite being aware of the role the UK plays in facilitating money laundering, critics argue that the government's response has been inadequate. The implementation of the Economic Crime Act was a step in the right direction, but its limitations and the lack of enforcement have hindered the fight against illicit financial activities. The UK's failure to thoroughly investigate the offshore connections and hidden assets of individuals like the Aliyev and Sharif families raises questions about its commitment to combating money laundering.

The Economic Crime Act and Its Limitations

The Economic Crime Act was introduced to strengthen regulations and enhance the UK's ability to tackle economic crimes, including money laundering. However, its effectiveness has been called into question. Critics argue that the act falls short in addressing the root causes of money laundering, such as anonymous company ownership and the lack of beneficial ownership transparency. Additionally, challenges in cross-border cooperation and limited resources for enforcement agencies have further hindered the act's impact.

Challenges in Identifying and Seizing Illicit Assets

The identification and seizure of illicit assets pose significant challenges for law enforcement agencies. The use of offshore structures, complex ownership networks, and the integration of illicit funds into legitimate financial systems make it difficult to trace and recover stolen assets. Limited international cooperation, inadequate resources, and a lack of transparency in financial transactions create obstacles in the fight against money laundering.

The Issue of Two-Tiered Justice and Western Hypocrisy

The issue of two-tiered justice arises when Western countries, known for championing the rule of law and transparency, fail to hold their own accountable for facilitating money laundering and harboring illicit wealth. This perceived hypocrisy undermines the credibility of Western nations in advocating for transparency and anti-corruption measures globally. Developing economies, particularly those affected by illicit financial flows, often bear the brunt of these actions, perpetuating inequality and hindering their progress.

In conclusion, Western complicity, particularly the role of the UK and offshore territories, has contributed to the global issue of offshore wealth and money laundering. The attractiveness of the UK as a destination for illicit wealth, criticism of the UK's response, the limitations of the Economic Crime Act, challenges in identifying and seizing illicit assets, and the issue of two-tiered justice and Western hypocrisy highlight the need for stronger regulations, transparency, and international cooperation to combat offshore wealth and money laundering.

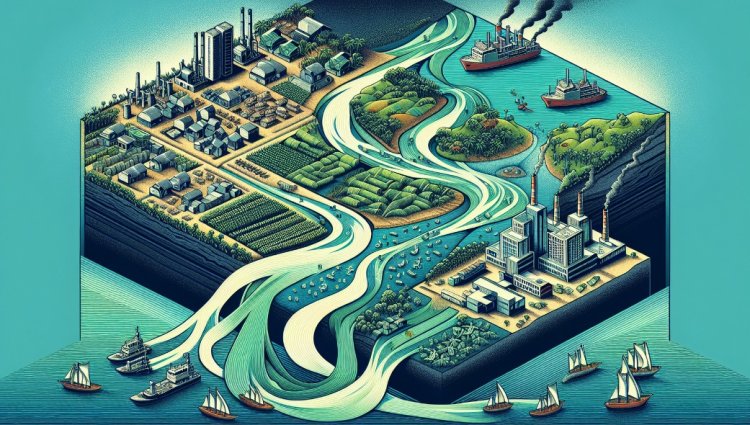

The Impact on Developing Countries: Capital Flight and Economic Consequences

Capital flight and the resulting economic consequences have a significant impact on developing countries. Offshore financial systems play a crucial role in facilitating illicit financial flows, exacerbating economic instability and inequality. The consequences of capital flight and offshore wealth for developing economies are far-reaching, requiring international cooperation, stronger regulations, and enforcement.

The Significance of Capital Flight for Developing Countries

Capital flight refers to the movement of assets and funds from developing countries to offshore tax havens. This practice deprives these countries of much-needed capital, hindering their economic growth and development. The flight of capital from developing countries drains resources that could be used for infrastructure development, education, healthcare, and poverty alleviation.

The Role of Offshore Financial Systems in Facilitating Illicit Flows

Offshore financial systems, characterized by low tax rates, secrecy laws, and lax regulations, enable individuals and businesses to hide their assets and engage in illicit financial activities. These systems provide a safe haven for corrupt elites to funnel their ill-gotten wealth, making it difficult for authorities to trace and recover stolen assets. Offshore structures and anonymous companies are often used to disguise the true origin of funds, facilitating money laundering and other illicit activities.

The Consequences of Economic Stability and Inequality

The flight of capital and the concentration of wealth in the hands of a few corrupt elites perpetuate economic instability and widen the wealth gap in developing economies. This concentration of wealth undermines social cohesion, exacerbates inequality, and hinders poverty reduction efforts. The majority of the population in these countries continues to live in poverty, while a small elite enjoys immense wealth and resources.

The Need for International Cooperation and Accountability

Addressing the issue of capital flight and offshore wealth requires international cooperation and accountability. Developing countries need support from the international community to strengthen their regulatory frameworks, enhance financial transparency, and recover stolen assets. Cooperation between governments, financial institutions, and civil society organisations is crucial in combating illicit financial flows and holding corrupt elites accountable.

Calls for Stronger Regulations and Enforcement

There is an urgent need for stronger regulations and enforcement to combat capital flight and offshore wealth. Countries must implement measures to increase transparency, strengthen anti-money laundering regulations, and enhance beneficial ownership transparency. Financial institutions and professionals must exercise due diligence in identifying and reporting suspicious financial activities. International organisations and governments should work together to close loopholes and ensure compliance with global standards.

In conclusion, capital flight and offshore wealth have severe economic consequences for developing countries. The role of offshore financial systems in facilitating illicit flows further exacerbates economic instability and inequality. Stronger regulations, international cooperation, and accountability are essential to addressing these issues and creating a more equitable and transparent financial system.

The Need for Action: Addressing Offshore Wealth and Money Laundering

Offshore wealth and money laundering are global issues that require immediate attention and action. The impact of these practices on developing economies and the global financial system cannot be underestimated. To address these issues effectively, several key areas need to be focused on:

The importance of transparency and accountability

Transparency and accountability are crucial in combating offshore wealth and money laundering. Governments, financial institutions, and individuals must be held accountable for their actions and the origins of their wealth. Public disclosure of financial transactions and ownership can help deter illicit activities and promote a more transparent financial system.

The role of international organisations in combating money laundering

International organisations, such as the United Nations and the Financial Action Task Force, play a vital role in coordinating efforts to combat money laundering. These organisations can provide guidance, technical assistance, and support to countries in implementing effective anti-money laundering measures.

The need for stronger regulations and enforcement

Stronger regulations and enforcement are necessary to prevent offshore wealth and money laundering. Countries must develop comprehensive and robust anti-money laundering frameworks that include measures to identify and trace illicit funds, as well as penalties for non-compliance.

The responsibility of both source and destination countries

Both source and destination countries have a responsibility to prevent and combat offshore wealth and money laundering. Source countries must implement effective measures to prevent the illicit outflow of funds, while destination countries must enhance their regulatory frameworks to detect and deter illicit financial activities.

The potential impact of public registers of beneficial ownership

Public registers of beneficial ownership can be a powerful tool in combating offshore wealth and money laundering. By making information about the true owners of companies and assets publicly available, these registers can help identify and expose illicit activities.

In conclusion, immediate action must be taken to address offshore wealth and money laundering. Transparency, accountability, stronger regulations, international cooperation, and the implementation of public registers of beneficial ownership are all key steps in combating these global issues. By working together, we can create a more equitable and transparent financial system that promotes integrity and accountability.

Conclusion

In conclusion, addressing offshore wealth and money laundering is of utmost importance in today's global financial landscape. Throughout this blog, we have explored the cases of the Kenyatta, Aliyev, and Sharif families, shedding light on the dark side of offshore wealth and its impact on developing economies.

Key points to take away from this discussion include the need for stronger regulations, transparency, and international cooperation to combat offshore wealth and money laundering. The cases of these corrupt elites highlight the urgency of addressing these issues and holding accountable those who exploit offshore tax havens and engage in money laundering.

Individuals, governments, and international bodies must take action to create a more equitable and just financial system. Transparency and accountability are paramount in exposing corruption and ensuring that those who amass significant wealth through questionable means are held responsible.

The importance of transparency and accountability cannot be overstated. It is through these principles that we can promote fairness, integrity, and trust in the financial system. By working together, we can strive for a more equitable distribution of wealth and resources and combat the detrimental effects of offshore wealth and money laundering.

The need for a more equitable and just financial system is evident. The concentration of wealth in the hands of a few corrupt elites perpetuates inequality and widens the wealth gap in developing economies. By addressing offshore wealth and money laundering, we can work towards a more balanced distribution of wealth and resources and create opportunities for sustainable development and poverty alleviation.

The urgency to address offshore wealth and money laundering cannot be underestimated. It is the responsibility of individuals, governments, and international bodies to take action and advocate for transparency, accountability, and stronger regulations. By doing so, we can strive towards a more equitable and just financial system that benefits all.

FAQ

Here are some common questions about offshore wealth and money laundering:

Common questions about offshore wealth and money laundering

-

What is offshore wealth?

-

What is money laundering?

-

How do individuals and businesses move their assets to offshore tax havens?

-

Why do individuals and businesses engage in offshore wealth and money laundering?

Answers addressing the impact on developing countries

-

How do offshore wealth and money laundering impact developing economies?

-

What are the economic consequences of capital flight?

-

How does offshore wealth contribute to economic inequality?

An explanation of the role of Western countries in facilitating illicit flows

-

What role do Western countries play in facilitating offshore wealth and money laundering?

-

Why are Western countries attractive destinations for illicit wealth?

-

What criticisms have been raised about the UK's response to money laundering?

Discussion of potential solutions and challenges in implementation

-

What are some potential solutions to combat offshore wealth and money laundering?

-

What challenges exist in implementing stronger regulations and enforcement?

-

How can international cooperation help address offshore wealth and money laundering?

Call to readers for further engagement and awareness

We encourage readers to further engage in discussions and raise awareness about the impact of offshore wealth and money laundering. By advocating for transparency, accountability, and stronger regulations, we can work towards a more just and equitable financial system.

admin

admin