The Deluge of Money: How Cheap Money is Flooding the World

"Explore 'The Deluge of Money' to understand the global impact of cheap money and its widespread availability. This insightful article examines the economic consequences, market dynamics, and financial trends resulting from the influx of inexpensive capital in economies worldwide."

The Deluge of Money: How Cheap Money is Flooding the World

Introduction

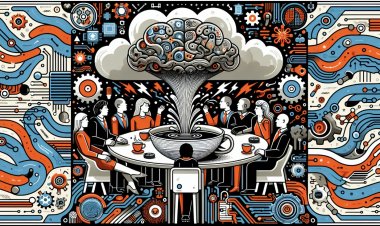

In today's world, money is more prevalent and cheaper than ever before. Central banks around the globe are pumping trillions of dollars and euros into the economy, flooding it with cheap money. While this may seem beneficial for investors and borrowers, it also comes with potential risks and consequences that cannot be ignored.

One of the key implications of this flood of money is the concentration of wealth at the top. As cheap money flows into shares and real estate, the prices of these assets continue to rise, benefiting the wealthy individuals who own them. This exacerbates the wealth gap, with a handful of super-rich individuals owning as much as the poorer half of the world's population combined.

Furthermore, the low-interest rates associated with cheap money have significant implications for savers. Those who rely on savings accounts are losing billions every year due to the minimal interest rates. As a result, individuals are seeking alternative ways to preserve their savings, such as storing physical cash or investing in assets like gold.

It is crucial to understand where all this money is going. Cheap money is fueling massive deals worth billions, with companies being bought and sold at inflated prices. The employees of these companies often become pawns of speculators, while the middle class loses out on their financial investments.

To navigate this financial landscape, individuals need to educate themselves on the implications and potential risks of cheap money. By understanding where the money is flowing and how it is impacting various sectors of the economy, individuals can make informed decisions and protect their financial well-being.

The Dilemma for Savers

While the flood of cheap money may seem beneficial for investors and borrowers, it has harmed savers. The low-interest rates associated with cheap money have significantly reduced the returns on savings accounts, causing individuals to lose billions of dollars every year. This has left savers with a dilemma as they struggle to find viable investment options for their hard-earned money.

Individuals like Carl Heinz Ice, a recently retired court bailiff, are finding it increasingly difficult to determine how to invest their savings in this world of low-interest rates. He had hoped to earn interest on his life insurance payout by reinvesting the money, but with interest rates so low, that plan is no longer feasible.

As a result, many savers are looking for alternative ways to preserve their savings. Some individuals, like Carl Heinz Ice's friends, are choosing to keep their money as physical cash in a safe deposit box. Others are turning to assets like gold, which they see as a more stable investment option in the face of low interest rates.

The European Central Bank (ECB) plays a significant role in causing these low-interest rates. The ECB has been steadily lowering base rates since the financial crisis, to achieve price stability. However, this has had the unintended consequence of leaving savers behind while countries with high levels of debt and ailing banks in southern Europe can access cheap money.

To address this dilemma, savers need to stay informed about the implications and potential risks of low-interest rates. By understanding where the flood of money is going and how it is impacting various sectors of the economy, individuals can make more informed decisions about their savings and seek out alternative investment options that align with their risk tolerance and financial goals.

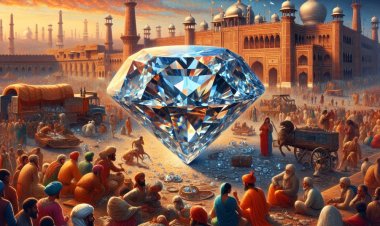

The Concentration of Wealth

One of the key consequences of the flood of cheap money is the concentration of wealth at the top. As central banks pump trillions of dollars and euros into the economy, the prices of assets like shares and real estate continue to rise. This benefits the wealthy individuals who own these assets and exacerbates the wealth gap. In fact, a handful of super-rich individuals now own as much wealth as the poorer half of the world's population combined.

An example of this concentration of wealth can be seen in billionaires like Bill Gates, whose fortune is valued at 65 billion euros. To put this into perspective, the total value of all the world's cash is less than 100 times that amount. The value of all goods and services created worldwide is 75 trillion euros, a stark contrast to the concentration of wealth held by a few individuals.

The correlation between cheap money and the concentration of wealth is evident in its impact on society. The low interest rates associated with cheap money have significant implications for savers. Those who rely on savings accounts are losing billions of dollars every year due to the minimal interest rates. This creates a dilemma for savers as they struggle to find viable investment options for their hard-earned money.

Furthermore, this concentration of wealth has a profound impact on society as a whole. It widens the wealth gap and exacerbates income inequality, leading to social unrest and discontent. The middle class and poorer citizens suffer as real estate prices and rents rise, while the financial investments of ordinary people lose value. This creates a system where money is moved from the bottom upwards, resulting in a gigantic redistribution machine.

To address this concentration of wealth and its impact on society, individuals must educate themselves on the implications and potential risks of cheap money. By understanding where the money is flowing and how it is impacting various sectors of the economy, individuals can make informed decisions and advocate for policies that promote a more equitable distribution of wealth.

The Dangers of Cheap Money

While the flood of cheap money may seem beneficial for investors and borrowers, it comes with significant dangers and risks that cannot be ignored. Economist Max Otte views cheap money as a symptom of a sick financial system, indicating underlying issues that need to be addressed.

One of the major dangers of cheap money is the increasing levels of debt it encourages. With interest rates so low, organisations and individuals are borrowing large amounts of money, often without fully considering the long-term consequences. This can lead to a cycle of debt and economic instability as debt becomes more difficult to repay.

The current flood of cheap money also raises concerns about the potential for future financial crises. The system of borrowing and lending based on cheap money is not sustainable in the long run. At some point, the dam will burst, and the financial system could face a major crisis, causing widespread economic damage.

Another consequence of cheap money is the widening wealth gap and growing inequalities. As central banks pump trillions of dollars and euros into the economy, the prices of assets like shares and real estate continue to rise. This benefits the wealthy individuals who own these assets, exacerbating the wealth gap. A handful of super-rich individuals now own as much wealth as the poorer half of the world's population combined.

Furthermore, the low-interest rates associated with cheap money have significant implications for savers. Those who rely on savings accounts are losing billions of dollars every year due to minimal interest rates. This creates a dilemma for savers as they struggle to find viable investment options for their hard-earned money, leading some to turn to storing physical cash or investing in assets like gold.

To mitigate the dangers of cheap money, individuals need to educate themselves on the implications and potential risks. By understanding where the money is flowing and how it is impacting various sectors of the economy, individuals can make more informed decisions about their financial well-being and advocate for policies that promote a more equitable distribution of wealth.

The Role of Private Banks

Private banks play a significant role in the creation and distribution of money in today's financial system. Understanding this process is crucial to comprehending the implications and risks associated with the flood of cheap money.

Money Creation Process

Contrary to popular belief, it is private banks, not central banks, that generate the majority of new money. When an individual or organisation borrows money from a private bank, the bank creates new money by issuing a loan. This money is then deposited into the borrower's account, effectively increasing the overall money supply.

This process of deposit money creation by private banks is a privileged power that allows them to profit greatly. Through the creation of loans, banks can generate interest income as well as charges associated with lending. This creates a snowball effect, as the money created by one loan is used to lend to others, further expanding the money supply.

Privileges and Profits

The ability of private banks to create money from nothing is a privilege that has historically been reserved for central banks or governments. However, with the current financial system, private banks have been granted this power, allowing them to reap substantial profits.

By creating money through loans, private banks can charge interest on the amount borrowed, effectively earning money from the interest payments made by borrowers. Additionally, banks can also charge fees for various banking services, further increasing their profits. This privilege of money creation has contributed to the concentration of wealth among the top echelons of society, as the wealthy individuals who own these banks benefit from the profits generated.

State Control of Money Creation

The unlimited power of private banks to create money and the profits they gain from it raises concerns about the need for greater state control over this process. Many argue that money creation should be a function of the state or central bank rather than being left solely in the hands of private banks.

Advocates for greater state control argue that it would help promote a more equitable distribution of wealth and ensure that money creation is used for the benefit of society as a whole. They propose measures such as fully backed money, where only the central bank is allowed to create money or the implementation of a financial transactions tax to regulate the activities of private banks.

Impact on the Financial System

The unlimited creation of loans and debts by private banks has significant implications for the stability of the financial system. The reliance on cheap money and the increasing levels of debt can lead to economic instability and a cycle of debt that becomes difficult to repay.

Furthermore, the concentration of wealth at the top, fueled by the profits generated by private banks, widens the wealth gap and exacerbates income inequality. The financial investments of ordinary people lose value, while the wealthy individuals who own shares and real estate continue to benefit.

To mitigate the risks and dangers associated with unlimited loans and debts, individuals need to educate themselves on the implications of cheap money and advocate for greater state control over money creation. By understanding where the money is flowing and how it is impacting the financial system, individuals can make informed decisions and support policies that promote a more equitable distribution of wealth.

The Call for Change

As the world continues to be flooded with cheap money, there is a growing call for change in the financial system. Various initiatives and proposals for financial system reform have emerged, seeking to address the risks and consequences associated with this deluge of money.

One of the key proposals is the concept of fully backed money, where only the central bank is allowed to create money. Currently, private banks have the privilege of creating money, which has led to significant profits and concentrations of wealth among the wealthy individuals who own these banks. By ending this privilege and ensuring that money creation is a function of the state or central bank, it is believed that a fairer and more sustainable financial system can be achieved.

Fully backed money would also have the benefit of reducing the levels of debt in the economy. With the current system of unlimited loans and debts encouraged by cheap money, there is a risk of economic instability and a cycle of debt that becomes difficult to repay. By implementing fully backed money, the creation of loans would be limited to the amount of money available, reducing the potential for a debt crisis.

Another proposed change is the implementation of a global financial transactions tax. This tax would regulate the activities of private banks and discourage speculative financial transactions. By levying a small tax on financial transactions, it would help to reduce excessive speculation and promote a more stable financial system.

Implementing these reforms would have significant benefits for both savers and society as a whole. Currently, savers are losing billions of dollars every year due to minimal interest rates on savings accounts. By restructuring the financial system and ensuring a fairer distribution of wealth, savers would have better investment options and the opportunity to earn reasonable returns on their savings.

Furthermore, a fairer and more sustainable financial system would help address the growing wealth gap and income inequality. Due to the profits made by private banks, the wealth gap is widening, which causes social unrest and discontent. By implementing reforms that promote a more equitable distribution of wealth, a fairer society can be achieved.

Overall, the recognition of the dangers and negative effects linked to the flood of cheap money is what has sparked calls for change in the financial system. By implementing initiatives such as fully backed money, reducing debts, and implementing a global financial transactions tax, it is possible to create a fairer and more sustainable financial system that benefits savers, society, and the economy as a whole.

Conclusion

As we have seen, the deluge of cheap money has had significant consequences and risks that cannot be ignored. The concentration of wealth at the top has been exacerbated, widening the wealth gap and leading to social unrest and discontent. Savers, on the other hand, are losing billions of dollars every year due to low-interest rates, leaving them with limited investment options for their hard-earned money.

This flood of cheap money has also led to increasing levels of debt, as organisations and individuals borrow large amounts without fully considering the long-term consequences. This cycle of debt and economic instability poses a significant danger to the financial system and could potentially lead to a major crisis in the future.

It is clear that the current financial system, which prioritises the profits of private banks, is not sustainable. There is an urgent need for a different financial system that prioritises the well-being of society as a whole. This includes implementing measures such as fully backed money, where only the central bank is allowed to create money, and implementing a global financial transactions tax to regulate the activities of private banks.

There is an urgency to rein in the world's financial system and promote change. By educating ourselves on the implications and potential risks of cheap money, individuals can make informed decisions and advocate for policies that promote a more equitable distribution of wealth. It is only through these changes that we can create a financial system that works for the benefit of society rather than a select few.

If you don't want to go through the stress of Forex but want to make money, join our Forex Managed Account Programme (links below).

TradeFxP Features

If you choose to be a self-employed retail trader, here are a few things we offer:

-

The best trading platform

-

No Requotes

-

Lowest Spreads

-

High-level liquidity

-

Interbank connectivity

-

Pure STP/DMA/ECN

-

Free signals

-

Best support

-

Crypto Wallet and withdrawals and deposits (USDT)

-

Robust CRM

-

TradeFxP wallet

-

Once you click withdrawal

-

Multiple payment options

-

Local offices to walk into

-

Free VPS

-

Free video chat and virtual meetings

-

And many more...

If you choose to be a part of our managed account programme,

-

All of the above +

-

1-2% Daily Profits

-

High-level risk management

-

Capital protection

-

Only 30% of the capital was used.

-

Negative balance protection

-

Our fee is from the profits only.

-

Monthly profit withdrawal

-

Wallet system: use it like PhonePe or Google Pay.

-

Crypto wallet and withdrawals/deposits (USDT)

-

Live monitoring

-

MyFxbook Live Monitoring

-

Copy Trading

-

And many more...

Optional: If you do not withdraw your profits for 2 months, our system will use those profits to trade and will keep your 100% capital safe and secure for margin purposes. This is optional, and if you choose not to be a part of it, you can withdraw your profits from the first month itself.

Why 1-2% daily? Can't your managed Forex account earn more?

Yes, we can! Remember: greed may be good in the beginning, but in the end, it will destroy everything. You and I know that! Many droplets make an ocean! Join the Managed Account Programme and sit back for six months, then look at your account. You'll see that our strategy is good and the best. Do you know what I mean?

If you choose to be a part of us as an introducing broker (IB) or channel partner,

-

Industry-best rebates

-

Local office support

-

Staff support

-

Marketing support

-

Marketing materials

-

And many more...

Having said that,

You can join our Forex Managed Account programme and earn 1-2% profits daily. See for yourself by clicking the below link.

Have a great journey, and may you catch some big waves on your way to prosperity!

To see Ai Forex Trading for real, use these credentials.

-

Low-risk strategy:

-

Mt4: 112018

-

PW: Allah@101

-

Server: TradeFxP live,

1. To read why you should be with us, click here.

2. To open an account, click here.

3. To see our regulation certificate, click here.

4. To see our news with the IFMRRC, click here.

5. For claims, click here.

6. For the main site, click here.

7. For blogs and articles, click here.

8. Main Website:www.TradeFxP.com

admin

admin