The Rise and Fall of Charles Ponzi: The Most Famous Fraudster in History

Unravel the meteoric rise and spectacular crash of Charles Ponzi, the mastermind behind the most infamous financial scam in history. Discover the secrets of his Ponzi scheme, the allure of "get-rich-quick" promises, and the lasting lessons for investors.

Introduction

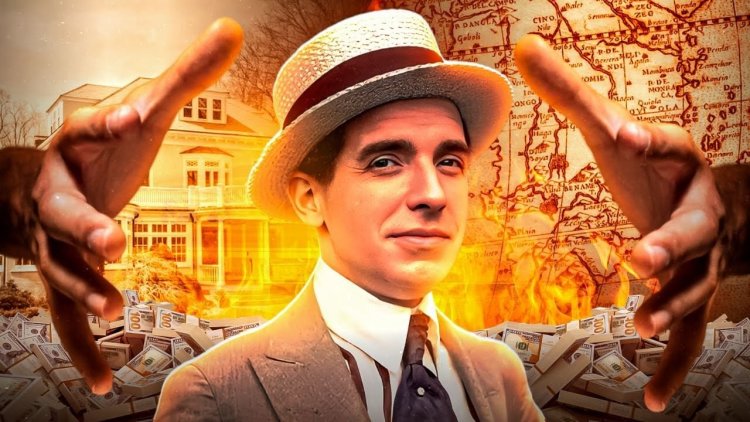

Charles Ponzi, an Italian immigrant, arrived in Boston in 1920 with a bold promise to investors: he could double their money in 90 days. Ponzi claimed to have discovered a low-risk, highly profitable arbitrage opportunity in foreign exchange markets. Little did anyone know that Ponzi's financial scheme would cause a calamity in Boston, leading to the collapse of several banks and cementing his place in history as the most infamous fraudster of all time.

During the 1920s, Boston was a thriving financial hub, vying with New York to be the center of finance in the United States. Ponzi arrived in the perfect setting for a man like him. A charismatic and intriguing figure, Ponzi was seen as a financial genius by his admirers and a fraudster by his critics. The contradictory nature of his character makes his story all the more fascinating.

It's important to note that the Ponzi scheme is often misunderstood and confused with a pyramid scheme. While pyramid schemes rely on recruiting new members to generate profit, Ponzi's scheme involved promising high returns to early investors using money from later investors. The money would flow in and out until the system eventually collapsed, leaving many investors empty-handed.

What sets Ponzi apart is his ability to convince people to trust him with their money. Despite his contradictory characteristics and questionable actions, Ponzi's story captivates us. Was he a brilliant mastermind or a fool? The answer is not clear-cut, as he displayed elements of both intelligence and naivety. From proposing intelligent investment ideas to falling for his own scheme, Ponzi's story is riddled with contradictions that make it truly intriguing.

Early Life and Failed Ventures

Charles Ponzi was born in Lugo, Italy, in 1882. Coming from a family of modest means, Ponzi's mother instilled in him the belief that he would restore their family name and fortune. In pursuit of wealth, Ponzi immigrated to the United States and settled in Boston in 1903.

Upon his arrival, Ponzi faced numerous challenges. He struggled to find stable employment and often found himself in financial difficulty. Despite these setbacks, Ponzi remained persistent in his pursuit of success.

Ponzi's first venture in Boston was his own fruit business, but it quickly failed. Undeterred, he moved on to other business ideas, including a failed attempt to establish a public utility company. Despite his inability to bring these ventures to fruition, Ponzi's entrepreneurial spirit and belief in his own ideas remained unwavering.

During this time, Ponzi also had several encounters with the law. He was arrested for forging a check and later served time in prison for his involvement in smuggling immigrants into the United States. These encounters with the law did little to dampen Ponzi's ambition and confidence.

Despite his failed ventures and brushes with the law, Ponzi continued to believe in his ability to make money through various investment schemes. He displayed both intelligence and naivety, proposing innovative investment ideas while simultaneously falling for his own fraudulent schemes.

Ultimately, Ponzi's early life and failed ventures provide insight into his character. He was a complex person who had ambition and a desire for wealth. While his ideas often proved unfeasible, Ponzi's unwavering belief in himself and his ability to convince others to trust him with their money set the stage for his infamous financial scheme.

The Birth of the Ponzi Scheme

Charles Ponzi's rise to infamy began with his discovery of the international reply coupon as an investment opportunity. In 1906, these coupons were introduced as a means to facilitate the exchange of mail across international borders. Ponzi realized that the fluctuation in exchange rates between different currencies presented an opportunity for profit.

However, instead of pursuing legitimate investments, Ponzi decided to take a different path. He initially attempted to start a magazine called "The Trader's Guide" to sell advertising space, but the venture failed due to a lack of content and advertising revenue. Undeterred, Ponzi began to develop his fraudulent scheme.

In 1920, Ponzi established the Securities Exchange Company, through which he issued what became known as "Ponzi notes." He promised investors a 50% return on their investment in just 90 days. This seemingly incredible offer attracted people from all walks of life who were eager to capitalize on the opportunity.

The Ponzi scheme operated by using money from new investors to pay returns to earlier investors. He claimed that his arbitrage activities with international reply coupons were what produced the returns. However, in reality, there was no legitimate investment or arbitrage taking place. The money from new investors was simply being used to pay off the earlier ones, creating the illusion of high returns.

As more investors were attracted by the promise of easy profits, Ponzi's operation grew rapidly. He utilized charisma and a convincing sales pitch to win the trust of his investors. Ponzi's reputation as a successful entrepreneur and his ability to pay out high returns further bolstered confidence in his scheme.

Despite the growing success of his operation, Ponzi's scheme was destined to collapse. The influx of new investors eventually slowed down, making it impossible to generate enough money to sustain the high returns promised to earlier investors. When the scheme finally unraveled, many investors lost their entire savings.

While Ponzi's scheme was not the first of its kind, his story remains infamous due to the scale and impact of his fraud. The Ponzi scheme has since become synonymous with this type of fraudulent investment operation.

Rapid Expansion and Financial Success

Charles Ponzi's scheme experienced exponential growth during its operation. In just a matter of months, his operation grew from handling a few thousand dollars to millions of dollars. The allure of high returns attracted a large number of investors who were eager to capitalize on the opportunity to double their money in a short period.

Ponzi established the Securities Exchange Company, which saw a flood of money from new investors. Ponzi's convincing sales pitch and reputation as a successful entrepreneur further fueled confidence in his scheme. People from all walks of life, including professionals, homemakers, and even journalists, were drawn to Ponzi's promises of easy profits.

As the scheme grew, Ponzi's extravagant lifestyle became more apparent. He lived in a luxurious home in Lexington, Massachusetts, and drove around in a high-end car. Ponzi's spending habits matched his newfound financial success, further adding to the allure of his scheme.

Despite the rapid expansion and financial success, Ponzi genuinely believed in his own ideas and business plans. He had genuine confidence in himself and his ability to make money through various investment schemes. This belief in himself was evident in his unwavering determination to pay back his investors and his constant pursuit of new investment opportunities.

However, as we will see in the next section, Ponzi's scheme was destined to collapse due to its unsustainable nature and the inability to generate enough funds to sustain the high returns promised to earlier investors.

The Boston Post investigation

Richard Grozier, the editor and publisher of the Boston Post, launched an investigation into Charles Ponzi and his financial scheme. As a prominent newspaper in Boston, the Boston Post had the influence and resources to uncover the truth behind Ponzi's claims.

The coverage of Ponzi's claims and the responses from experts shed light on the deceptive nature of his scheme. The newspaper made it clear that Ponzi's promises of high returns in a short period were implausible and unsustainable.

As the investigation continued, skepticism surrounding Ponzi's scheme grew. People began to question the legitimacy of his operations and his ability to generate such high returns. Experts and financial analysts weighed in, pointing out the mathematical inconsistencies and the unrealistic nature of Ponzi's claims.

Legal action was taken against Ponzi as a result of the investigation. The Boston Post's reporting played a crucial role in exposing Ponzi's fraudulent activities and alerting authorities to take action. The Securities Exchange Company, Ponzi's business, faced scrutiny and regulatory intervention.

Furthermore, the run on the Securities Exchange Company occurred as a direct result of the Boston Post's coverage. As people became increasingly skeptical and aware of the risks involved, they rushed to withdraw their investments. This led to a chaotic situation, with long lines forming outside the company's offices and an influx of pickpockets taking advantage of the crowded streets.

Despite the run on the company, Ponzi remained calm and continued to pay back investors. He rented additional office space to accommodate the rush of people and ensured that everyone who requested their money received their principal and interest payments.

However, the investigation and negative press surrounding Ponzi's scheme ultimately exposed the truth and led to its downfall. The Boston Post's relentless coverage, along with the involvement of regulatory authorities, played a significant role in bringing an end to Ponzi's fraudulent activities.

Regulatory Scrutiny and Collapse

As Charles Ponzi's financial scheme gained momentum, it also attracted the attention of regulatory agencies. Ponzi's promise of high returns and his rapid expansion caught the eye of authorities, who began investigating his operations.

Regulatory agencies, such as the Securities Exchange Commission, started looking into Ponzi's claims and the legality of his investment scheme. As more information came to light, it became clear that Ponzi was not engaging in legitimate investment activities. Instead, he was using money from new investors to pay returns to earlier investors, creating a classic Ponzi scheme.

The run on the Securities Exchange Company was a direct result of regulatory scrutiny and the media coverage surrounding Ponzi's activities. News of the investigation and the realization that the scheme was unsustainable caused panic among investors. They rushed to withdraw their investments, leading to long lines outside the company's offices and a chaotic atmosphere.

Ponzi attempted to defend his scheme, claiming that he was engaged in arbitrage activities with international reply coupons. However, his defense fell apart under scrutiny, as experts and financial analysts pointed out the mathematical inconsistencies and unrealistic nature of his claims.

The Boston Post played a crucial role in exposing Ponzi's fraudulent activities. The newspaper launched an investigation into Ponzi and published articles questioning the legitimacy of his operations. The negative press and the involvement of regulatory authorities significantly impacted the Ponzi scheme.

Ponzi also faced lawsuits, including one against the Boston Post and journalist Clarence Barron. These legal battles further eroded his credibility and added to the public's skepticism.

Ultimately, the effects of regulatory scrutiny, the run on the Securities Exchange Company, and Ponzi's failed attempts to defend his scheme and silence his critics led to the collapse of his fraudulent operation. The limitations of the Ponzi scheme became evident as it became impossible to sustain the high returns promised to earlier investors with the money from new investors.

The story of Charles Ponzi serves as a cautionary tale about the dangers of fraudulent investment schemes and the importance of regulatory oversight to protect investors and maintain the integrity of financial markets.

Ponzi's Legacy and Unravelling

After the initial success and rapid expansion of Charles Ponzi's financial scheme, the aftermath of his fraudulent operation began to unfold. Despite the growing number of investors and the influx of funds, Ponzi's scheme was destined to collapse.

Overview of the Aftermath

As more people became aware of Ponzi's operation, skepticism grew, and questions about the legitimacy of his activities arose. The Boston Post, a prominent newspaper at the time, launched an investigation into Ponzi and published articles questioning the feasibility of his high returns.

Legal actions were taken against Ponzi, and regulatory authorities started scrutinizing his claims and the legality of his investment scheme. The Securities Exchange Commission became involved, and it became clear that Ponzi was not engaging in legitimate investment activities.

Ponzi's Continued Belief

Despite mounting legal troubles and regulatory scrutiny, Ponzi continued to believe in his ability to turn things around. He remained confident in his investment schemes and was determined to pay back his investors.

However, Ponzi's belief in himself and his ability to generate enough funds to sustain the high returns promised to earlier investors proved to be misguided.

Legal Troubles, Counterfeit Notes, and Dwindling Funds

Ponzi faced lawsuits, including one from the Boston Post and journalist Clarence Barron. His credibility began to crumble as legal battles and negative press surrounded his scheme.

Furthermore, regulatory authorities intervened, freezing some of Ponzi's accounts. The run on his company occurred as a result of the negative press and the realization that the scheme was unsustainable.

Ponzi's financial situation started to unravel. He struggled to convert the international reply coupons into cash and faced difficulties sustaining the high returns promised to investors.

Impact of the Scheme and Lasting Influence

Ponzi's scheme had a significant impact on the Boston community. Many investors lost their entire savings, leading to financial ruin for numerous individuals and families.

The collapse of Ponzi's scheme left a lasting legacy, as the term "Ponzi scheme" became synonymous with this type of fraudulent investment operation. It serves as a cautionary tale about the dangers of fraudulent schemes and the importance of regulatory oversight in protecting investors.

Additional Business Ventures and Final Years

After the collapse of his Ponzi scheme, Charles Ponzi embarked on various business ventures and faced numerous failures. Despite his previous unsuccessful ventures, Ponzi was determined to become a wealthy businessman. He attempted to buy ships, convert debt into equity, and explore other investment opportunities.

However, Ponzi's subsequent business ideas also proved to be unsuccessful. He faced financial difficulties and struggled to make his ventures profitable. Despite these failures, Ponzi remained unwavering in his confidence and belief in himself.

During this time, the postal inspector launched an investigation into Ponzi's activities. New post office regulations were implemented to address fraudulent schemes like Ponzi's. The investigation and new regulations ultimately played a significant role in unraveling Ponzi's fraudulent operation.

Despite the collapse of his Ponzi scheme and subsequent failed ventures, Ponzi's story serves as a cautionary tale about the dangers of fraudulent investment schemes and the importance of regulatory oversight.

Conclusion and FAQ

Summary of Charles Ponzi's Rise and Fall as a Fraudster:

Charles Ponzi, an Italian immigrant, arrived in Boston in 1920 with a bold promise to investors: he could double their money in 90 days. Through his scheme, Ponzi promised high returns by using money from later investors to pay returns to earlier investors.

Reflection on the enduring fascination with Ponzi's story:

Ponzi's story captivates us because it raises questions about his true nature, intelligence, and naivety. His contradictory characteristics and actions make his story intriguing and complex.

Addressing frequently asked questions about Ponzi schemes and their impact:

-

What is the difference between a Ponzi scheme and a pyramid scheme?

-

In a Ponzi scheme, the fraudster promises high returns using funds from later investors to pay returns to earlier investors. In a pyramid scheme, participants make money by recruiting new members.

-

How did Ponzi convince people to trust him with their money?

-

Ponzi's charisma, convincing sales pitch, and reputation as a successful entrepreneur played a crucial role in gaining the trust of his investors.

-

What was the impact of the Ponzi scheme?

-

The Ponzi scheme led to the collapse of several banks and caused many investors to lose their savings, resulting in financial ruin for numerous individuals and families.

Final thoughts on the legacy of Charles Ponzi:

Charles Ponzi's story serves as a cautionary tale about the dangers of fraudulent investment schemes and the importance of regulatory oversight. The term "Ponzi scheme" has become synonymous with this type of fraudulent operation.

admin

admin