The Rise and Fall of Evergrande: A Story of China's Property Sector and Debt

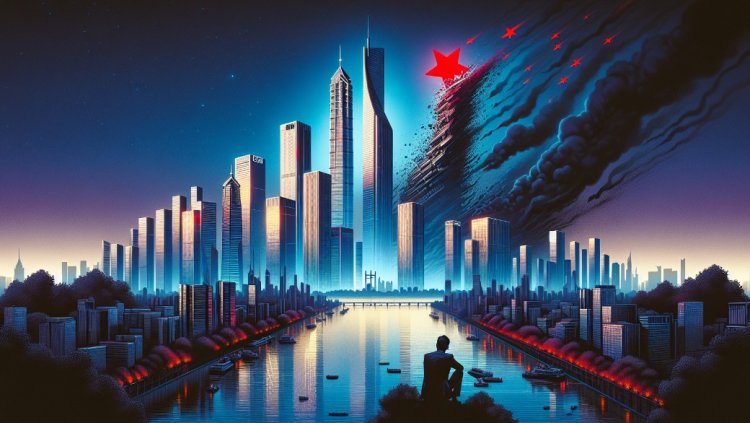

Discover the dramatic story of Evergrande, China's once-mighty property giant, from its meteoric rise to its spectacular fall. Explore the causes of its collapse, its impact on the Chinese economy, and the potential consequences for the global financial system.

Introduction

The Rise and fall of Evergrande is a story that sheds light on the immense changes in the Chinese economy, particularly in the property sector and its debt crisis. This story revolves around the staggering levels of debt and leverage within China's property industry, which has been a driving force behind the country's economic growth for decades.

Overview of the transcript

The transcript tells the tale of Evergrande, once the world's largest real estate developer, and its rapid expansion in the Chinese property market. It delves into the significant role of the property sector in China's economy, accounting for a third of its economic output. Additionally, it explores the historic migration of millions of Chinese farmers to cities, creating a massive demand for housing and fueling the property boom.

Introduction to Evergrande and its significance

Evergrande, founded by Hui Ka Yan in 1997, grew rapidly to become a dominant player in the Chinese property market. The company amassed $150 billion in assets within just ten years, making it the most indebted property company in the world. Evergrande's success and subsequent downfall exemplify the risks associated with excessive leverage and the potential consequences for China's economy.

The focus on debts and the property sector in China

The transcript emphasizes the central role of the property sector in China's economic growth, with a significant portion of the population moving from rural areas to cities. This mass migration created a vast demand for housing, leading to a property boom and substantial debt accumulation. The blog will further explore the challenges posed by this debt-fueled growth and the implications for China's financial industry and global markets.

The Importance of the Property Sector in China

-

China's property sector has been a driving force behind the country's economic growth for decades.

-

Approximately a third of China's economic output is attributed to the property sector, highlighting its significance.

-

The property boom in China can be attributed to various factors, including the historic migration of millions of Chinese farmers to cities, creating a massive demand for housing.

-

The property sector in China has had significant impacts on employment, with construction workers accounting for over 10% of the country's total workforce.

-

Additionally, land sales related to the property sector contribute to almost a third of local government fiscal revenue.

-

The property sector's importance in China's economy is unparalleled compared to other countries like the US or the UK, where the ratio of economic output attributed to property falls below 20%.

The meteoric rise of Evergrande

Founding and rapid expansion of Evergrande

Evergrande, founded by Hui Ka Yan in 1997, experienced a rapid rise to become a dominant player in the Chinese property market. Within just ten years, the company amassed $150 billion in assets, making it the most indebted property company in the world. The booming Chinese real estate market and the enormous housing demand brought about by the historic migration of millions of Chinese farmers to cities were the driving forces behind this unprecedented growth.

Hui Ka Yan as the founder and his success

Hui Ka Yan, the founder of Evergrande, played a crucial role in the company's success. Hui, who is well-known for his charisma and exceptional sales skills, took advantage of the chance that the widespread migration of people from rural areas to cities in China presented. He had a keen eye for spotting trends and quickly became a poster boy for the immense wealth that could be generated from Chinese real estate.

The boom in building projects and sales

Evergrande's rapid expansion was characterised by a boom in building projects and skyrocketing sales. The company embarked on numerous projects in cities across mainland China, building apartments to meet the soaring demand for housing. This boom was fueled by a combination of factors, including the aspirations of the middle class to own their own homes, housing affordability issues, and the availability of debt and credit for property developers.

Evergrande's financial growth and success as a poster boy

From 2004 to 2020, Evergrande experienced staggering financial growth, with its total revenue growing at an annualised rate of 44%. With over $300 billion of liabilities, the company became a symbol of excessive leverage and the risks associated with it. Hui Ka Yan's success and Evergrande's meteoric rise made them poster boys for the potential wealth that could be achieved in the Chinese real estate market.

Signs of Trouble and the Three Red Lines

Government efforts to control and limit debt

The Chinese government has been making efforts to control and limit the debt levels in the country, particularly in the property sector. With the property sector accounting for a third of China's economic output, there was a growing concern about the risks associated with excessive leverage and the potential consequences for the economy.

Introduction of the Three Red Lines Policy

To address the mounting debt crisis, the Chinese government introduced the three red lines policy for property developers. This policy imposes three debt ratios that developers must follow to gain access to bank lending. The ratios include a liability-to-asset ratio of less than 70%, a net gearing ratio of less than 100%, and a cash-to-short-term debt ratio of more than one.

How Evergrande's debts exceeded the limits

Evergrande, being the most indebted property company in the world, struggled to meet the requirements of the three red lines policy. With over $300 billion of liabilities, Evergrande's debt far exceeded the limits set by the government. This raised concerns about the company's ability to repay its debts and sparked fears of a potential bankruptcy.

Impact on Evergrande's access to credit and borrowing

As Evergrande's debts exceeded the limits set by the three red lines policy, the company faced significant challenges in accessing credit and borrowing. Banks became cautious about lending to Evergrande, and the government advised them to slow down the issuance of mortgage loans. As a result, Evergrande's ability to sell apartments and generate cash flow was severely hampered.

Warnings and Challenges in the Property Market

Concerns about the property market's sustainability

The rapid expansion and excessive leverage in China's property sector have raised concerns about its sustainability. The property market has been a driving force behind the country's economic growth for decades, but there are growing worries about the risks associated with the high levels of debt.

Increase in empty apartments and housing affordability issues

One of the challenges in the property market is the increase in empty apartments. The ratio of empty homes in China is estimated to be between 10% and 50%, with enough empty homes to house about 90 million people, greater than the population of Germany or the UK. This oversupply has contributed to housing affordability issues, with it taking more than 50 years of median household income in Beijing to buy an average apartment.

Lack of consideration for logistics and oversupply

The rapid pace of construction in China has resulted in some developments being built without proper consideration for logistics and oversupply. This has led to entire apartment blocks standing empty, even in areas with limited job opportunities. The lack of demand for these oversupplied properties further exacerbates the issue of empty apartments.

The government's efforts to control leverage and debt

In response to the mounting debt crisis, the Chinese government has implemented measures to control leverage and debt in the property sector. The introduction of the "three red lines" policy for property developers is aimed at limiting their access to bank lending. This policy sets debt ratios that companies must follow, including a liability-to-asset ratio of less than 70%. However, many major developers, including Evergrande, have struggled to meet these requirements, leading to challenges in accessing credit and borrowing.

Evergrande's Downfall and Default

Investors' loss of confidence and impact on global markets

Evergrande's rapid descent and default on its debts have triggered a significant loss of confidence among investors, both domestically and globally. The collapse of Evergrande, once the world's largest real estate developer, has sent shockwaves through financial markets, leading to increased uncertainty and volatility. Global investors who had put their money into Evergrande's wealth management products are now facing the possibility of not getting their money back, causing widespread panic and concern.

Missed payments and defaults on offshore debts

In September 2021, Evergrande missed payments on its wealth management products, causing distress among its investors. The company then neglected to make an interest payment on one of its dollar bonds, which was the first significant default on offshore debts by a Chinese property developer. The default has had a cascading effect on the entire bond market for the Chinese property sector, with other property companies now struggling to raise financing on offshore markets. The default has also shattered the belief that China would bail out its prominent property players, leading to a loss of trust in Chinese companies.

Potential consequences and comparisons to Lehman Brothers

The collapse of Evergrande has raised concerns about the potential consequences for China's financial industry and the global economy. The company's massive debts, amounting to $300 billion, pose a significant risk to China's property sector and its overall economy. If Evergrande fails to restructure its debts, it could result in a prolonged period of bankruptcy proceedings and have unimaginable consequences for China's property market. Some analysts have drawn comparisons between Evergrande's default and the collapse of Lehman Brothers, which triggered the 2008 financial crisis, highlighting the potential systemic risks.

Auditors' role and investigations into Evergrande

The collapse of Evergrande has raised questions about the role of auditors, particularly PwC, which had been auditing the company's accounts for years. The audit regulator in Hong Kong has launched an investigation into PwC's work, as Evergrande's sudden inability to meet its financial obligations has exposed potential shortcomings in the auditing process. This investigation highlights the need for greater scrutiny and accountability in the auditing industry to prevent similar failures in the future.

Implications and Future Outlook

The impact on China's economic model and growth

The collapse of Evergrande marks a pivotal moment for China's economic model and growth. For decades, the property sector has been a driving force behind China's economic growth. However, Evergrande's excessive leverage and debt accumulation in the industry have raised questions about the viability of this growth model. China's reliance on property as the prime locomotive of economic growth may need to shift towards greener and more stable industries.

Shift towards greener and more stable growth.

The Evergrande crisis has highlighted the need for China to transition towards greener and more stable growth. The government's efforts to control leverage and debt in the property sector, such as the introduction of the "three red lines" policy, reflect a push towards a more sustainable economic model. Investment in green industries and a focus on environmental sustainability can help mitigate the risks associated with excessive debt and contribute to long-term economic stability.

Loss of trust and credibility for Evergrande

Evergrande's downfall has resulted in a loss of trust and credibility for the company. The default on debts and the uncertainty surrounding the company's future have alarmed investors both domestically and internationally. This loss of trust extends beyond Evergrande and has raised questions about the reliability of other Chinese companies. The collapse of Evergrande has shattered the belief that China would bail out its prominent property players, leading to a loss of trust in Chinese companies.

Lessons learned and potential changes in policies

The Evergrande crisis has provided valuable lessons for China's policymakers. It has exposed the risks associated with excessive leverage and debt-fueled growth in the property sector. As a result, there may be potential changes in policies to control leverage, limit debt, and promote more sustainable economic growth. The government's implementation of the "three red lines" policy for property developers is just one example of efforts to address the debt crisis and prevent similar failures in the future.

Conclusion

The rise and fall of Evergrande is a story that highlights the immense changes in the Chinese economy, particularly in the property sector and its debt crisis. Evergrande's rapid expansion and subsequent default on its debts exemplify the risks associated with excessive leverage and the potential consequences for China's economy. The story sheds light on the importance of the property sector in China, which accounts for a third of the country's economic output. The historic migration of millions of Chinese farmers to cities created a massive demand for housing and fueled the property boom.

However, the Evergrande crisis has also revealed challenges and warnings in the property market. The increase in empty apartments, housing affordability issues, and oversupply have raised concerns about the sustainability of the property market's growth. The Chinese government's efforts to control leverage and debt with the introduction of the three red lines policy reflect a shift towards sustainable growth.

The collapse of Evergrande and the potential consequences have significant implications for China's economic model and growth. It highlights the need for a transition towards greener and more stable industries. The loss of trust and credibility for Evergrande and the lessons learned from this crisis may lead to changes in policies to control leverage and promote sustainable economic growth. Overall, the Evergrande story serves as a reminder of the importance of sustainable growth and the risks associated with excessive debt in China's economy.

admin

admin