How Banks Actually Work: A Complete Guide

"Delve into 'How Banks Actually Work: A Complete Guide' to understand the intricate workings of the banking system, covering everything from basic operations to complex financial transactions."

Introduction

Welcome to our complete guide to how banks actually work. TradeFxP is proud to be bootstrapped, meaning that we have built our success from the ground up without any investor money.

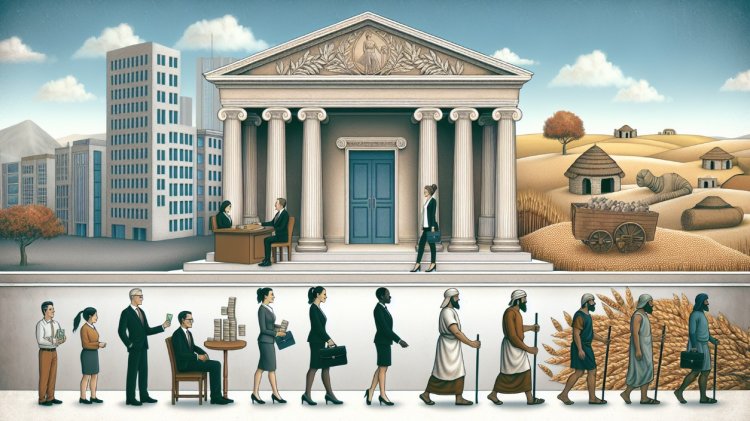

Before we delve into the intricacies of banking, let's provide some historical context. Banking has been an integral part of human civilization for centuries. From ancient Mesopotamia to the Roman Empire, the history of banking is filled with examples of financial systems and regulations that have shaped our modern-day practices.

A Brief History and Timeline of Banking

The history of banking stretches back thousands of years, with various civilizations and periods contributing to its evolution. Understanding this history provides valuable insights into the development of modern banking practices.

Overview of ancient banking (2000 BCE–100 CE)

Ancient Mesopotamia is credited with having the first recorded evidence of banking activity. Merchants provided grain loans to farmers and traders, while temples and palaces served as repositories for valuables and issued loans to citizens. The Code of Hammurabi from ancient Mesopotamia contains laws related to financial transactions and commercial activities, highlighting the sophistication of financial systems during this time.

Explanation of banking in Rome (100 BCE to 500 CE)

Roman banks, known as mensai, were involved in currency exchange, deposit-taking, and lending. Individuals called argentari bankers or money changers played a significant role in the financial system. These bankers set up their businesses in the Forum, the center of commercial and political life in ancient Roman cities.

Discussion of medieval banking (500 CE to 1400 CE)

After the fall of the Roman Empire, banking activity decreased in Western Europe but continued in the Byzantine Empire and the Islamic world. The Knights Templar, a Christian military order, established an early form of international banking, allowing pilgrims to deposit and withdraw funds across their network of commanderies.

Description of the Rise of Modern Banking (1400 CE to 1700 CE)

The rise of modern banking saw the development of central banks and the establishment of banking systems in various countries. The Medici family in Renaissance Italy introduced the double-entry bookkeeping system. Central banks, such as the Bank of Amsterdam, the Swedish Reichsbank, and the Bank of England, provided stability and regulation to banking systems.

Explanation of banking during the Industrial Revolution (1700 CE to 1900 CE)

The Industrial Revolution brought rapid economic growth and increased demand for banking services. Joint-stock banks emerged, allowing people to pool resources and invest in new ventures. Central banks began to issue banknotes and manage the money supply. The gold standard became the dominant global monetary system, facilitating international trade and investment.

Overview of banking in the 20th century

The 20th century witnessed the rise of multinational banks, the automation of banking services, and the development of credit cards and electronic payment systems. The gold standard collapsed during the Great Depression, leading to the creation of regulatory bodies and insurance schemes to protect depositors.

Discussion of banking in the 21st century

The 21st century brought about the proliferation of online banking and digital currencies, such as Bitcoin. The 2008 global financial crisis prompted renewed regulatory efforts to bolster financial stability and consumer protection. The future of banking in the coming years is uncertain, but technological advancements and changing customer preferences are expected to shape its evolution.

The importance of understanding the history of banking

Understanding the history of banking is crucial for comprehending the foundation upon which the entire economy is built. It provides insights into the development of financial systems, regulations, and practices. This knowledge can help individuals and businesses navigate the complexities of the modern banking landscape and make informed financial decisions.

How Banks Worked in the Era of the Gold Standard

During the era of the gold standard, banks operated under a monetary system where the value of a country's currency was directly linked to a fixed quantity of gold. This system had its origins in the use of gold coins as a medium of exchange, and it gained widespread acceptance by the late 19th century.

Explanation of the Gold Standard

Under the gold standard, central banks committed to exchanging their currencies for a specific amount of gold upon demand. This ensured the stability of the currency and facilitated international trade. Countries began issuing paper currency backed by gold reserves, allowing for the expansion of the money supply without the need for additional gold.

Origins of the Gold Standard

The use of gold as a standard for currency can be traced back to ancient times. It became more formalized during the Roman Empire when banks were involved in currency exchange, deposit-taking, and lending. The gold standard gained widespread acceptance in the late 19th century, with countries like the United States and Great Britain adopting it.

Flaws and Limitations of the Gold Standard

While the gold standard provided stability to the monetary system, it had inherent flaws and limitations. One major flaw was its inflexibility during economic crises. Since the money supply was tied to gold reserves, governments found it difficult to increase liquidity and stimulate economic growth during recessions or depressions.

Another limitation was the requirement for countries to maintain large reserves to back their currencies. This led to the hoarding of gold and limited its availability, which in turn slowed global economic growth. Additionally, the gold standard contributed to speculative attacks on currencies, as investors would sell a country's currency if they perceived its gold reserves to be insufficient.

Abandonment of the Gold Standard in the Early 20th Century

In response to the outbreak of World War I, many countries temporarily suspended the gold standard to finance their war efforts. The Great Depression in the 1930s further prompted countries, including the United States, to abandon the gold standard altogether, as they needed more flexibility to combat the economic crisis.

Establishment of the Bretton Woods Agreement

In the aftermath of World War II, the Bretton Woods Agreement was established to create a new international monetary system. The U.S. dollar became the basis of this system, pegged to gold. However, the growing trade deficits and inflationary pressures forced the United States to abandon the gold convertibility of the dollar in 1971.

The End of the Gold Standard Era and the Rise of Fractional Reserve Banking

The abandonment of the gold standard marked the end of its era, and fractional reserve banking became the prevailing system. Fractional reserve banking allows banks to hold only a fraction of their customers' deposits in reserve, while the remainder can be loaned out or invested. This system stimulates economic growth by fueling lending and investment, but it also poses risks such as bank runs and inflation.

Advantages and Disadvantages of Fractional Reserve Banking

Fractional reserve banking, the prevailing system in modern banking, has both advantages and disadvantages. Understanding these pros and cons is essential to comprehend the implications and potential risks associated with this financial system.

Advantages of Fractional Reserve Banking

-

Economic Growth: Fractional reserve banking stimulates economic growth by fueling lending and investment. By lending out a portion of their customers' deposits, banks increase the money supply, which in turn supports investment and consumption. This leads to the creation of new jobs and industries, contributing to overall economic expansion.

-

Profitability: Fractional reserve banking allows banks to generate income from interest and fees on loans and investments made with customer deposits. This profitability ensures the sustainability of banks and can lead to increased shareholder value, attracting further investment in the financial sector.

-

Financial Intermediation: Banks play a critical role in financial intermediation, connecting borrowers and savers in the economy. Fractional reserve banking enables banks to extend credit to borrowers, providing businesses and individuals with the capital they need to grow and innovate. This intermediation facilitates the efficient allocation of financial resources and promotes economic development.

Disadvantages of Fractional Reserve Banking

-

Bank Runs: Fractional reserve banking can make banks vulnerable to bank runs, where a large number of customers choose to withdraw their deposits simultaneously due to concerns about the bank's solvency. Since banks only hold a fraction of their deposits in reserve, they may not have enough cash on hand to meet withdrawal demands, leading to a crisis of confidence and potential financial instability.

-

Inflation: The process of creating new loans in a fractional reserve banking system can lead to an increase in the money supply. If the growth of the money supply outpaces the growth in economic output, it can result in inflation, eroding the purchasing power of money and potentially causing economic imbalances.

-

Excessive Risk-Taking: Fractional reserve banking can encourage excessive risk-taking by banks as they seek to maximise profits through lending and investment. This behaviour can lead to the misallocation of resources and contribute to the formation of asset bubbles. In the event of a financial crisis, banks with high levels of risky loans and investments may face insolvency, necessitating government intervention or bailouts.

Connection to the 2008 Financial Crisis

The 2008 global financial crisis, which was primarily due to excessive risk-taking and the collapse of the US housing market, revealed the weaknesses of fractional reserve banking. Banks with significant exposure to risky mortgage-backed securities faced insolvency, leading to a credit freeze and widespread economic turmoil. This crisis highlighted the need for stricter regulation and oversight of the financial sector to prevent excessive risk-taking and ensure the stability of the banking system.

Types of banks and services

An Explanation of Retail Banks and Their Services

Retail banks, also known as consumer banks, primarily serve individual customers and small businesses. They offer a wide array of banking services, including:

-

Checking and savings accounts: Retail banks provide customers with deposit accounts that allow them to securely store their money, offering varying degrees of interest and accessibility.

-

Loans: These banks extend various types of loans, such as personal loans, auto loans, and mortgages, to help customers finance their needs and goals.

-

Credit cards: Retail banks issue credit cards that enable customers to make purchases on credit and repay the balance at a later date, typically with interest.

-

Payment services: Consumer banks facilitate various forms of payment processing, such as check clearing, electronic fund transfers, and bill payments.

-

Foreign exchange: These banks also offer currency exchange services, assisting customers in converting one currency to another for travel or other purposes.

An Overview of Commercial Banks and Their Services

Commercial banks primarily cater to businesses, both small and large, providing a range of financial services to support their operations and growth. Some of the services offered by commercial banks include:

-

Business loans: Commercial banks provide businesses with loans and lines of credit to finance expansion, working capital, equipment purchases, and other needs.

-

Trade finance: These banks offer trade finance services, such as letters of credit and guarantees, to facilitate international trade and mitigate risks associated with cross-border transactions.

-

Treasury management: Commercial banks provide cash management services to help businesses optimise their cash flow, manage liquidity, process payments efficiently, and offer foreign exchange and hedging services to mitigate currency, interest rate, and commodity price risks.

Description of Investment Banks and Their Services

Investment banks specialise in capital markets activities and advisory services, primarily serving large corporations, institutional investors, and governments. Some of the services provided by investment banks include:

-

Mergers and acquisitions advisory: Investment banks advise clients on corporate transactions, such as mergers, acquisitions, and divestitures, providing strategic guidance and valuation expertise.

-

Underwriting: These banks assist clients in raising capital through debt and equity offerings, acting as intermediaries between issuers and investors, and underwriting securities offerings.

-

Asset management: Investment banks manage portfolios of securities and other financial assets on behalf of institutional clients, such as pension funds, mutual funds, and insurance companies.

-

Trading and market making: These banks engage in securities trading, acting as market makers by buying and selling securities to maintain liquidity and facilitate efficient price discovery in financial markets.

Introduction to Central Banks and Their Role

Central banks, unlike the banks mentioned above, do not deal directly with the public. They are independent organisations that have received permission from a government to monitor the country's monetary policy and money supply. Some of the key roles and responsibilities of central banks include:

-

Monetary policy: Central banks control the money supply and interest rates to achieve macroeconomic objectives such as stable inflation, economic growth, and low unemployment.

-

Lender of last resort: They act as a lender of last resort to commercial banks in times of financial distress, providing emergency liquidity to maintain the stability of the financial system.

-

Supervision and regulation: Central banks oversee the banking sector, establish prudential regulations, and monitor the solvency and risk management practices of banks to ensure their soundness and stability.

Conclusion

Reflecting on the longevity of banking, it is clear that this industry has been an integral part of human civilization for centuries. From ancient Mesopotamia to the present day, banking has evolved and adapted to meet the needs of society.

Watching this video multiple times can greatly enhance your understanding of how banks work. With the complex history and intricacies of modern banking, it is important to take the time to absorb and comprehend the information presented.

Now, we invite you to share your vision of the future of banking. How do you think this industry will evolve in the coming years? What innovations and changes do you anticipate? We are eager to hear your thoughts and ideas in the comments below.

admin

admin