The Secret World of Commodity Traders: Unveiling the Complexities and Impact

Beyond oil barons and Wall Street whispers, lies the hidden realm of commodity traders. Dive into their intricate strategies, global influence, and real-world impact. Unmask the thrill and risk of trading oil, metals, and more, gaining a deeper understanding of the forces shaping our daily lives.

Introduction

Due to the rise of new economic superpowers like China and India, the demand for raw materials in the 20th century reached unprecedented levels. This scramble for commodities led to soaring prices, resulting in hunger riots in developing countries in 2008. While China's appetite for raw materials played a significant role, it is clear that the markets themselves bear some responsibility.

There is a need to investigate the role of speculators in manipulating markets. Speculators can artificially create the perception of a shortage, driving prices higher and causing instability. It is crucial to understand who these speculators are and how they operate in the complex and opaque commodities markets.

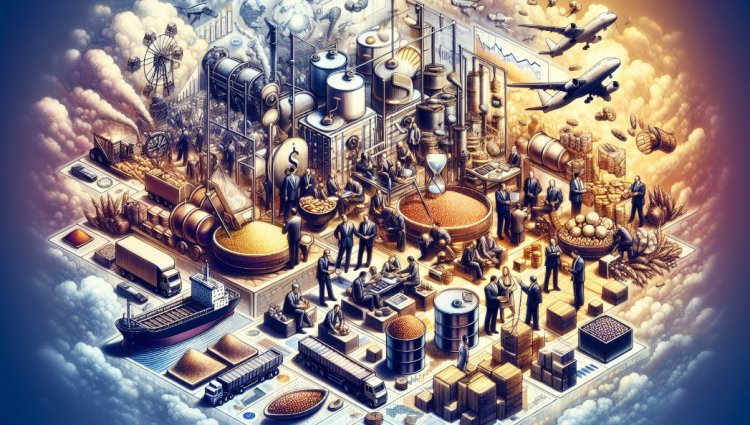

Commodities traders, who buy and ship raw materials, play a central role in these markets. They are members of an old corporation that thrives on secrecy. These traders take risks based on their experience, intelligence, and intuition. Their goal is not to exploit others but to take calculated risks and make profits. They are the market makers and merchants of the commodities world.

Geneva has become the hub for commodities trading, with hundreds of trading companies based there. Among them are giants like Vital, the world's leading oil trader, and the ABCD Group, which dominates 80% of the world's grain market. However, little is known about these business giants due to their secrecy and aversion to media attention.

While trading in commodities has a long history, the arrival of new economic powers, the influence of speculators, and the rise of computer bots programmed with algorithms have transformed the market. These changes have brought benefits and challenges, leading to debates about the ethics and transparency of the trading industry.

In the coming sections, we will delve deeper into the world of commodities trading, exploring the dynamics, risks, and impacts of this complex and often misunderstood industry.

The Mysterious World of Commodity Traders

Commodity traders play a vital role in the buying and selling of raw materials. They are members of an old corporation that thrives on secrecy and takes risks based on their experience, intelligence, and intuition. Their goal is not to exploit others but to take calculated risks and make profits. They are the market makers and merchants of the commodities world.

Geneva has become the hub for commodities trading, with hundreds of trading companies based there. Giants like Vital, the world's leading oil trader, and the ABCD group dominate the market. However, these business giants are shrouded in secrecy and have an aversion to media attention.

The role of a commodities trader is not without risks. The commodities market is complex and volatile, and traders need expertise to navigate it successfully. They must analyse and interpret information from around the world, anticipate price fluctuations, and make timely decisions. Speculation is part of the job, but it is important to differentiate between healthy speculation and manipulation.

The world of commodity trading is characterised by secrecy and anonymity. Traders prefer to remain hidden from the public eye and cultivate anonymity. This secrecy adds to the allure and mystique of the industry. While some traders may be camera-shy, their impact on the global economy is undeniable.

In conclusion, commodities traders play a crucial role in the global economy by buying and selling raw materials. They operate in a complex and often misunderstood industry, taking calculated risks to make profits. Geneva serves as the epicentre of commodities trading, housing major players like Vital and the ABCD Group. The secrecy and anonymity surrounding traders add to the intrigue of this mysterious world.

The Controversial Figures: Mark Rich and Glencore

Mark Rich, a legendary figure in the oil business, revolutionised the industry in the 1970s. He was known for his exceptional language skills, networking abilities, and talent for taking risks. Rich's company facilitated trade between Iran and Israel, even during the Tehran hostage crisis. This controversial move landed him on the FBI's most wanted list and forced him to seek asylum in Switzerland, where he lived until he died in 2013. Rich's business practices were often on the edge of legality and ethics, leaving a lasting mark on the industry.

In addition to Mark Rich, another powerful player in commodities trading is Glencore. This secretive and influential company operates globally with a turnover of over $250 billion. Despite its significant impact on the market, Glencore remains shrouded in secrecy. The company's operations and connections are closely guarded, making it difficult for the public to gain insight into its activities.

Glencore's lack of transparency is not unique. Many other business giants in the commodities trading industry prefer to remain hidden from the public eye. This secrecy adds to the intrigue and mystique of the sector. While some traders may be camera-shy, their impact on the global economy cannot be ignored.

The lack of public knowledge about companies like Glencore raises questions about the ethics and transparency of the trading industry. The influence these giants have on prices and markets is significant, yet their operations remain largely unknown to the general public. It is important to continue exploring and understanding the complexities of commodities trading to ensure fairness and accountability in the industry.

Behind the Scenes: The Life of a Trader

Have you ever wondered what it's like to be a commodities trader? In this section, we will provide some insight into the day-to-day life of a trader and the important role they play in the commodities market.

Knowing the product and market

One of the most crucial aspects of being a trader is having a deep understanding of the product and market they are dealing with. Traders must analyse and interpret information from around the world to anticipate price fluctuations and make timely decisions. This requires extensive knowledge of the specific commodity they are trading, as well as the factors that influence its supply and demand.

For example, let's take a look at traders in the coffee and cotton industries. Coffee traders, like Patrick Masson, must be familiar with different coffee suppliers and their quality. They need to assess the geographic and price risks associated with buying and selling coffee. Similarly, cotton traders, such as Armand Ezers, need to have expertise in evaluating the quality of cotton and understanding the needs of textile companies. They also have to navigate the logistics of shipping the cotton to its destination.

The Global Nature of Trading

Trading is a global business, and traders often need to travel to establish relationships with suppliers, negotiate deals, and ensure the quality of the products they are trading. Tarek al Kassinda, a coffee trader, travels regularly to producing countries to meet with clients and assess crop development. Armour Ezers, a cotton trader, visits cotton spinners in different countries to sell them cotton and ensure customer satisfaction.

This global perspective is essential because commodities trading is interconnected with economies and markets around the world. Traders need to stay informed about political, economic, and environmental factors that can impact the supply and demand of commodities.

It's important to highlight that while trading offers profit opportunities, it also involves risks. Traders take calculated risks based on their experience, intelligence, and intuition. They are aware that mistakes can lead to sizable financial losses, but the potential rewards drive them.

In conclusion, the life of a trader is characterised by a deep knowledge of the product and market, the ability to make strategic decisions, and the need for global awareness and travel. Traders play a vital role in the commodities industry by facilitating the buying and selling of raw materials, and they contribute to the global economy through their expertise and risk-taking.

Navigating the Markets: Speculation and Risk

Speculation plays a significant role in trading, allowing traders to take calculated risks to make profits. Traders are not in the business of exploiting others, but rather, they use their experience, intelligence, and intuition to make strategic decisions. They are the market makers and merchants of the commodities world.

One of the key impacts of speculation on markets is its effect on prices and volatility. Speculators can artificially create the perception of a shortage, driving prices higher and causing instability. This can have significant consequences, as seen in the 2008 hunger riots in developing countries. It is important to differentiate between healthy speculation, which contributes to fair exchange, and manipulation, which distorts the market and can lead to negative outcomes.

A notable case study of speculation in commodities trading is Anthony Ward's cocoa trading. Ward, known as "Chocolate Finger," bought almost all the cocoa stocks on the Ivory Coast, the world's largest exporter. Shortly after, a civil war broke out in Abidjan, causing cocoa prices to skyrocket. This example highlights the potential for speculators to have a significant impact on prices and markets.

To manage the risks associated with speculation, traders often turn to futures markets. Futures markets are derivative products that allow traders to hedge against price fluctuations. They serve as a form of insurance, covering traders against volatile market conditions. These markets were created to address the risk that insurance companies refused to cover, as the risk of price fluctuations in commodities is not easily quantifiable.

The Chicago Board of Trade, a legendary centre of the agricultural commodities market, is a prominent example of a futures market. Paper traders, like Trez Knipper, deal in futures contracts, buying and selling them based on market conditions. These contracts allow traders to manage their risk and potentially make profits.

The rise of computer bots programmed with algorithms has introduced a new element to speculation and trading. High-frequency bots work by the millisecond and can rapidly take buying and selling positions based on market fluctuations. While these bots can generate significant profits, they can also contribute to market volatility and irrational behaviour.

Overall, speculation and risk are inherent in commodities trading. Traders must navigate the complexities of the market, analyse global information, and make strategic decisions. While speculation can contribute to fair exchange, it is important to monitor and address potential risks and ensure transparency and ethical behaviour in the industry.

The Influence of Financial Markets and Institutions

The rise of investment institutions and their impact on commodities markets

Examination of the financial bubble and its effect on prices

Critique of the lack of transparency in the market

Introduction to computer bots and their role in trading

Impacts on Producers and Food Security

Speculation in commodity trading has significant impacts on small producers and global food security. Here are some key points to consider:

Effects of Speculation on Small Producers

Speculators in commodity markets can artificially create perceptions of shortages, driving up prices and causing instability. This can be detrimental to small producers, who may struggle to cope with price volatility and fluctuations. These producers often lack the resources and infrastructure to navigate such market conditions, leaving them vulnerable to financial losses.

Furthermore, small producers may have limited options when it comes to selling their products. They are often reliant on middlemen or traders to buy their goods, which can result in limited bargaining power and lower profits. Speculation can exacerbate these issues, making it even more challenging for small producers to make a sustainable income.

Vulnerability of Net Importer Countries

Net importer countries, particularly those in the developing world, are at increased risk due to speculation in commodity markets. These countries rely heavily on imports to meet their food needs, and any disruptions or price fluctuations can have severe consequences for their food security.

When prices increase due to speculation, it becomes more difficult for net-importing countries to afford the necessary commodities. This can lead to higher food prices for their populations, making it harder for people to access nutritious meals. In extreme cases, it can even lead to hunger riots and social unrest, as seen in various developing countries in 2008.

Case Study: The Cotton Crisis in 2008

The cotton crisis in 2008 provides a notable example of the impacts of speculation on commodity markets. Investment funds and big banks bought up large numbers of cotton contracts, causing prices to double within a few months. This had severe consequences for traders and small producers.

Traders faced panic as they couldn't sell their cotton due to the inflated prices, leading to significant financial losses. Small producers, on the other hand, struggled with the volatile market conditions and were unable to benefit from the price increase. This kind of speculation distorts the market and can lead to bankruptcies and financial instability.

The Role of Financial Markets in Pricing Agricultural Raw Materials

Financial markets, such as the Chicago Board of Trade, play a significant role in the pricing of agricultural raw materials through futures markets. These markets allow traders to hedge against price fluctuations and manage their risk.

However, the rise of investment institutions and computer bots programmed with algorithms has introduced new complexities to the market. High-frequency bots, for example, can rapidly take buying and selling positions based on market fluctuations, contributing to market volatility and irrational behaviour.

Overall, it is important to monitor and address the impacts of financial markets on commodity pricing to ensure fairness, transparency, and accountability in the industry. This will help protect the interests of small producers and promote global food security.

The Future of Trading: Consolidation and Commoditization

In the ever-evolving world of commodities trading, the future holds several significant changes that are likely to impact the industry. One major prediction is that big producers themselves will become traders. This would result in a consolidation of power within the industry, as these producers would have the resources and infrastructure to trade directly, bypassing smaller trading companies. This trend could potentially disrupt the traditional trading model and reshape the dynamics of the market.

While this consolidation may benefit big producers, it could hurt small farmers. With producers becoming traders, small farmers may struggle to find buyers for their products. They may lose bargaining power and face limited options for selling their goods. The consolidation of power among big producers could lead to further challenges for small farmers, making it harder for them to compete and make a sustainable income.

One prominent group of big producers in the industry is the ABCD group, which includes giants like Cargill. These companies not only dominate the market as producers but also operate as industrialists and financiers. This vertical integration allows them to have control over various aspects of the trading process and further solidifies their position in the industry.

While big producers have the advantage of scale and resources, smaller trading companies face several challenges. These companies often lack the financial backing and infrastructure of their larger counterparts, making it difficult for them to compete. Additionally, smaller trading companies may struggle to navigate the complexities of the market and face greater risks in an increasingly competitive landscape.

Overall, the future of trading in the commodities industry is likely to be characterised by consolidation and commoditization. Big producers becoming traders themselves could reshape the industry and impact the livelihoods of small farmers. The ABCD group, with its dominance in the market, represents the changing dynamics of the industry. Smaller trading companies may face challenges as they strive to compete in an evolving and increasingly competitive market.

FAQ

Here are some common questions and concerns about commodity trading:

What is commodity trading?

Commodity trading involves buying and selling raw materials, such as oil, grain, coffee, and cotton. Traders take calculated risks based on their experience, intelligence, and intuition to make profits.

Why is trading important?

Trading plays a crucial role in the global economy by facilitating the buying and selling of raw materials. It allows producers to reach global markets and consumers to access a diverse range of products. It also creates opportunities for profit and economic growth.

Are there ethical considerations in commodity trading?

Yes, ethical considerations are important in commodity trading. Transparency and fair exchange are key principles that traders should adhere to. It is crucial to differentiate between healthy speculation, which contributes to fair exchange, and manipulation, which distorts the market and can lead to negative outcomes.

What is the future direction of commodity markets?

The future of commodity markets is likely to be characterised by consolidation and commoditization. Big producers may become traders themselves, resulting in a consolidation of power within the industry. This trend could reshape the dynamics of the market and potentially impact small farmers. It is important to closely monitor the impacts of these changes and ensure fairness, transparency, and accountability in the industry.

admin

admin