The Advantages of Managed and AI-Powered Forex Trading Accounts

Discover the advantages of managed and AI-powered Forex trading accounts, including improved risk management and higher profitability.

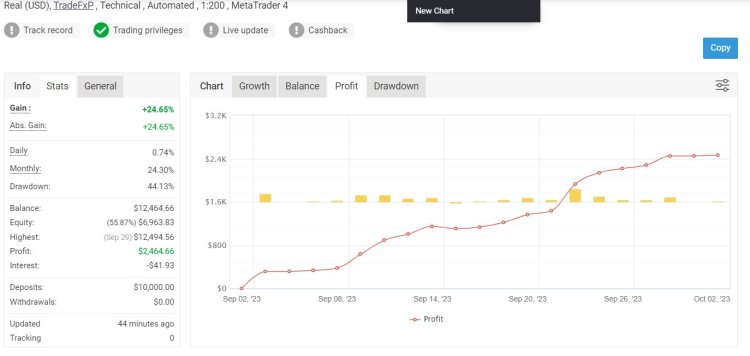

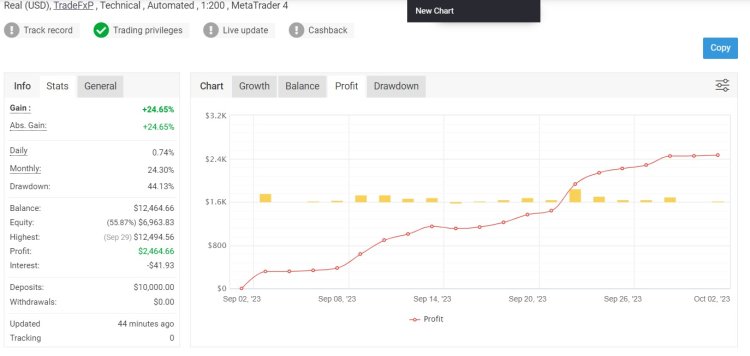

This Image is of TradeFxP real account: Image Courtsy: MyFxbook

1. The Advantages of Managed and AI-Powered Forex Trading Accounts

When it comes to forex trading, there are a lot of different approaches that traders can take. Some people prefer to trade on their own, while others opt for managed accounts. And more recently, there has been a third option that has been gaining popularity: AI-powered forex trading accounts.

So, what are the advantages of each type of account? Let's take a look:

Managed Accounts:

The main advantage of managed accounts is that they can provide traders with peace of mind. When you hand over the reins to a professional money manager, you don't have to worry about things like market analysis, entry and exit points, and risk management. All of that will be taken care of for you.

Another advantage of managed accounts is that they can be a good option for those who don't have the time or experience to trade on their own. If you have a full-time job or other commitments that leave you little time to trade, a managed account can be a convenient way to still participate in the forex market.

AI-Powered Accounts:

The biggest advantage of AI-powered forex trading accounts is the fact that they are automated. This means that once you set up your account and configure your settings, the trading bot will do all the work for you. All you need to do is sit back and watch your account grow.

Another advantage of AI-powered accounts is that they can take emotion out of the equation. We all know that emotions can be one of the biggest enemies of successful trading. But when you're using a bot, there's no emotion involved. The bot just follows the numbers and makes trades accordingly.

Finally, AI-powered accounts can often execute trades faster than human traders can. This is because bots can process large amounts of data much faster than humans can. So, if you're looking for an edge in the market, an AI-powered account may be just what you need.

2. The Benefits of Automated and Artificial Intelligence Forex Trading

When it comes to forex trading, there are many different approaches that traders can take. Some traders prefer to do things manually, while others are more comfortable using automated or artificial intelligence (AI) systems. There are benefits and drawbacks to both approaches, and it ultimately comes down to personal preference as to which one is best.

Manual forex trading requires the trader to be constantly monitoring the markets, looking for opportunities to buy or sell. This can be a full-time job in itself, and it is not uncommon for manual traders to spend hours in front of their computer screens. For some people, this is the perfect way to trade—they enjoy the challenge and the constant need to be alert and ready to take action.

However, there are also benefits to using automated or AI systems. These systems can do all the hard work for you, leaving you free to focus on other things. They can also place trades faster than you could ever hope to, and they can often do so with a higher degree of accuracy. This is because they are not subject to the same emotional biases that humans are.

If you are thinking of venturing into forex trading, then you should definitely consider the benefits of using an automated or AI system. These systems can give you an edge over other traders, and they can help you make more profitable trades.

3. Maximising Returns with Managed Forex Accounts

When it comes to investing, there are a lot of different options out there. For the average investor, trying to pick the right investment can be a daunting task. Managed forex accounts have become a popular option in recent years, due to the potential for high returns with little effort on the part of the investor.

But what exactly are managed forex accounts? And how do they work? In this article, we'll take a closer look at managed forex accounts and how they can help you maximise your returns.

What are managed forex accounts?

Managed forex accounts are simply investment accounts that are under the supervision of qualified money managers. The money manager will trade the account on your behalf, using their expertise to try to generate profits.

There are a few different ways that managed forex accounts can be structured. The most common type of managed forex account is a pooled account. This is where a group of investors pool their money together, and the money manager trades the account as a whole.

Another type of managed forex account is a single account. This is an account that a money manager manages on behalf of a single investor, as the name suggests.

The third type of managed forex account is a joint account. This is similar to a single account, but there are two investors involved. The money manager will make trades on behalf of both investors and will usually split the profits (or losses) evenly between them.

How do managed forex accounts work?

Managed forex accounts can be a great way to boost your returns without having to put in a lot of work. The money manager will do all the heavy lifting for you, making trades and trying to generate profits.

Of course, you will need to select a reputable and experienced money manager to handle your account. It's important to do your due diligence before selecting a money manager, as you want to make sure that they have a good track record and that you're comfortable with their investment strategy.

Once you've selected a money manager, you will need to deposit funds into your account. The amount of money you need to deposit will depend on the money manager and the type of account you're opening.

After your account is funded, the money manager will begin making trades. They will buy and sell currency pairs, trying to generate profits for the account. The profits (or losses) will be added to or deducted from your account balance.

The frequency of trades will also vary, depending on the money manager. Some money managers will make multiple trades per day, while others may only make a few trades per week.

What Are the Benefits of Managed Forex Accounts?

There are a few key benefits that make managed forex accounts an attractive option for investors.

First, managed forex accounts offer the potential for high returns. While there are no guarantees in the world of investing, a skilled money manager can generate significant profits for their clients. This potential for high returns is one of the biggest draws for managed forex accounts.

Second, managed forex accounts are relatively low-risk. Unlike other investments, such as stocks and commodities, the foreign exchange market is much less volatile. This means that there is less risk of big losses, which can be a major advantage for conservative investors.

Third, managed forex accounts are easy to set up and manage. Unlike other investments, there's no need to open and manage a brokerage account. All you need to do is find a reputable money manager and deposit funds into your account. The money manager will take care of the rest.

Fourth, managed forex accounts offer flexibility and liquidity. You can withdraw your funds at any time, without penalty. This flexibility can be a major advantage if you need to access your money for unexpected expenses or opportunities.

Fifth, managed forex accounts are taxed at a lower rate than other investments. Capital gains from managed forex accounts are taxed at a maximum rate of 15%, which is lower than the rate for stocks, bonds, and other investments.

Should You Open a Managed Forex Account?

Managed forex accounts can be a great way to boost your returns without having to put in a lot of work. However, there are a few things to keep in mind before opening an account.

First, managed forex accounts are not suitable for everyone. If you're not comfortable with the idea of someone else managing your money, then a managed Forex account is probably not right for you.

Second, managed forex accounts come with fees. Most money managers will charge a percentage of the profits they generate for the account (known as a performance fee). Make sure you're aware of all the fees involved before opening an account.

Third, managed forex accounts are subject to fraud. While there are many reputable money managers out there, there are also a lot of scams. Be sure to do your research before selecting a money manager, and only invest with someone who has a good track record and is regulated by a reputable organisation.

Fourth, managed forex accounts are not guaranteed to make money. Even the best money managers can have losing streaks. Be prepared for the possibility of losses, particularly in the short term.

Overall, managed forex accounts can be a great way to invest without having to put in a lot of work. However, there are some risks and downsides to keep in mind before opening an account. Be sure to do your research and only invest with a reputable and experienced money manager.

4. Managed Forex Trading: Identifying Risk and Opportunity

When it comes to managed forex trading, it is important to identify both risk and opportunity. This can be a difficult task, as there are many factors to consider when making investment decisions. However, by understanding the basics of risk and opportunity, you will be better equipped to make informed decisions about your investments.

There are two main types of risk involved in managed forex trading: market risk and account risk. Market risk is the risk that the value of your investment will go down due to market conditions. This type of risk is out of your control and can be difficult to predict. Account risk is the risk that you will lose money due to factors such as poor trade execution or margin calls. This type of risk is within your control and can be managed through proper risk management.

In addition to market and account risk, there is also the risk of fraud. This type of risk is often difficult to identify, as there are many scams in the forex market. Always do your research and only invest with reputable brokers.

Opportunity also exists in the forex market. By taking advantage of favourable market conditions, you can make a profit on your investment. It's crucial to keep in mind that the amount of risk you're willing to take will determine your profit potential.

When it comes to managed forex trading, it is important to carefully consider both risk and opportunity. By doing so, you will be better equipped to make informed investment decisions.

5. Exploring the Advantages of AI-Powered Forex Strategies

In today's world, more and more businesses are turning to artificial intelligence (AI) to help them automate various tasks. AI-powered forex trading strategies are becoming increasingly popular for a number of reasons. Here are just a few of the advantages of using AI in forex trading:

1. Increased accuracy AI-powered forex trading strategies can take into account a large number of factors that humans simply couldn't process on their own. This can lead to more accurate predictions about market movements and better results overall.

2. Increased speed Another advantage of AI-powered forex strategies is that they can execute trades much faster than human traders. This is important because the forex market is incredibly fast-moving, and even a few seconds can make a big difference in the outcome of a trade.

3. Reduced emotions One of the biggest benefits of using AI in forex trading is that it can help take emotion out of the equation. This is important because emotions can often lead to poor trading decisions. With AI, trades are executed based on logic and data rather than emotions.

4. 24/7 trading. One of the great things about using AI in forex trading is that it can be done 24 hours a day, 7 days a week. This is because AI never gets tired and can continue to process data and execute trades around the clock.

5. Increased flexibility AI-powered forex trading strategies can be customised to each individual trader's needs and preferences. This is important because not all traders are alike, and what works for one trader may not work for another.

If you're looking for a way to improve your forex trading results, then you should definitely consider using AI-powered forex strategies. With their many benefits, it's easy to see why they're becoming more and more popular.

6. Eliminating Human Error with AI-Powered Trading Systems

As technology has continued to evolve, so has the world of online trading. One of the most significant advancements in recent years has been the rise of artificial intelligence (AI) in the financial sector. AI-powered trading systems are now able to perform tasks that were once only possible for humans, such as analyzing large amounts of data and making split-second decisions.

There are many benefits to using AI-powered trading systems, but perhaps the most important is that they can help eliminate human error. We are all humans, and as such, we are all susceptible to making mistakes. Whether it's due to fatigue, emotion, or simply not having enough information, there are many factors that can lead to errors in judgement when trading.

AI-powered trading systems can help overcome these problems by providing a second set of eyes on the market. They can also make decisions much faster than a human can, which is often critical in the world of online trading.

Another benefit of using AI-powered trading systems is that they can help improve your financial education. As you may already know, one of the key components of successful trading is continuing to learn and evolve your strategy. AI-powered trading systems can provide you with valuable insights into the market that you may not have otherwise had access to.

Lastly, another benefit of using AI-powered trading systems is that they can help you build a diversified portfolio. Many TradeFxP fund managers now use AI-powered systems to help them make decisions about which assets to add to their portfolios. By using an AI-powered system, you can help to ensure that your portfolio is well-diversified and that you're investing in a variety of assets that have the potential to generate returns.

Overall, there are many reasons why you should consider using an AI-powered trading system. They can help to eliminate human error, improve your financial education, and build a diversified portfolio. If you're looking for a way to take your trading to the next level, an AI-powered system may be the answer.

7. Understanding Forex Risk and Hedging Strategies

If you're new to online forex trading, you might be feeling a bit overwhelmed by all of the jargon and strategies. Don't worry, we're here to help. In this blog, we're going to take a deep dive into understanding forex risk and hedging strategies.

When it comes to online forex trading, there are two main types of risk: market risk and credit risk. Market risk is the risk of the currency pair you're trading moving against you. Credit risk is the risk that the counterparty to your trade doesn't fulfil its obligations.

There are a few different ways to hedge against market risk. One popular method is to use expert advisors, which are computer programmes that monitor the markets and make trades for you. Another option is to use artificial intelligence (AI) forex trading systems, which can analyse data and make trades based on market conditions.

Credit risk can be more difficult to hedge against, but one way to do it is to trade with a large and well-established broker. This way, you can be sure that they have the financial resources to fulfil their obligations.

Of course, no hedging strategy is perfect, and there's always the possibility that you could lose money. However, if you're aware of the risks and have a well-thought-out hedging strategy in place, you can minimise your losses and maximise your chances of success in online forex trading.

8. Exploring the Benefits of Automated Risk Management

When it comes to automated risk management, there are a number of benefits that make it an attractive option for forex traders. Perhaps the most obvious benefit is the fact that it can help to take the emotion out of trading, which can be a big advantage.

Another benefit is that it can help promote discipline in trading. This is because, with automated risk management in place, traders are less likely to take excessive risks or to deviate from their chosen trading strategy. This can be a big benefit in terms of long-term profitability.

Automated risk management can also help save time. This is because the process of setting up and maintaining stop-losses and other risk management parameters can be time-consuming. By automating this process, traders can free up time to focus on other aspects of their trading.

Overall, automated risk management can be a valuable tool for forex traders. It can help to take the emotion out of trading, promote discipline, and save time.

9. Generating Higher Profits with AI-Powered Forex Trading

If you're looking to generate higher profits from your forex trading, then you should definitely consider using an AI-powered system. After all, AI technology is constantly evolving and getting better and better, so it stands to reason that an AI-powered system would be able to give you an edge over the competition.

There are a number of different AI-powered forex trading systems available on the market today, so it's important to do your research and choose one that's right for you. I personally use the MagikMarket Trident Bot, which is a fully automated forex trading system that uses AI to place trades on my behalf. I've found it to be highly effective, and it's helped me generate consistent profits day after day.

If you're serious about becoming a more profitable forex trader, then an AI-powered system is definitely worth considering. With the right system in place, you could be making daily profits and taking your trading to the next level.

10. The Benefits of AI-Based Forex Backtesting and Optimisation

Forex trading is a popular activity all over the world, and India is no exception. In fact, with the country's large population and growing economy, there is a huge demand for foreign currency. However, due to the volatile nature of the forex market, trading can be a risky business. This is where AI-based forex backtesting and optimization come in handy.

Backtesting is the process of testing a trading strategy on historical data to see how it would have performed in the past. This is a valuable tool for forex traders, as it allows them to see how a particular strategy would have worked under different market conditions.

Optimisation is the process of finding the best settings for a trading strategy to maximise its performance. This is also a valuable tool for forex traders, as it allows them to fine-tune their strategies to get the best results.

Both backtesting and optimisation are essential for forex trading success. However, they can be time-consuming and require a lot of manual work. This is where AI comes in.

AI-based backtesting and optimisation can be done much faster and more accurately than traditional methods. This is because AI can process large amounts of data much faster than humans. Additionally, AI can identify patterns that humans are likely to miss.

This is why AI-based backtesting and optimisation are becoming increasingly popular among forex traders. Not only does it save time, but it can also lead to better results.

11. Getting Started with Managed and AI-Powered Forex Trading Accounts

If you're like most people, you probably think of forex trading as a way to make money by speculation. And while it's true that forex trading can be very profitable, it's also a risky business. So, how do you get started with managed forex trading accounts?

The first step is to find a reputable forex broker. There are many brokers out there, but not all of them are created equal. Make sure to do your research and select a broker that is subject to regulation by a reputable organisation, such as the National Futures Association (NFA), the Commodity Futures Trading Commission (CFTC), or the IFMRRC.

Once you have chosen a broker, you will need to open a managed forex account. This type of account is different from a regular forex account in that you will not be able to trade directly. Instead, your broker will trade on your behalf.

Managed forex accounts can be a great way to get started in forex trading. However, there are a few things you should keep in mind. First, you will need to deposit a minimum amount of money with your broker. This is typically around $1000. Second, you will need to be comfortable with the fact that your broker will be making all of the decisions for you.

If you're looking for a more hands-on approach, you may want to consider an AI-powered forex trading account. These types of accounts use artificial intelligence to trade on your behalf.

AI-powered forex trading accounts have a number of benefits. First, they can help take the emotion out of trading. Second, they can trade 24 hours a day, 7 days a week. And third, they can oftentimes provide better returns than traditional managed forex accounts.

If you're interested in getting started with an AI-powered forex trading account, make sure to do your research. There are a number of different providers out there, and not all of them are created equal. Make sure you choose a provider that has a good track record and that offers a money-back guarantee.

Once you've chosen a provider, you will need to open an account and fund it. Again, the minimum amount you will need to deposit is typically around $1000.

Once your account is funded, you will need to choose your trading strategy. There are a number of different strategies you can choose from, so make sure to do your research and choose one that fits your goals and risk tolerance.

Once you've chosen your strategy, you will need to set up your account. This process will vary depending on the provider you choose, but typically it involves linking your account to a broker and setting up your trade parameters.

After your account is set up, you will need to select your trade signals. These signals will tell your software when to buy or sell a particular currency pair. There are a number of different ways to get trade signals, so make sure to do your research and choose a method that fits your needs.

Once you have your trade signals, you will need to set up your software to trade on your behalf. This process will again vary depending on the provider you choose, but typically it involves setting up an auto-trading system that will execute trades for you based on the signals you've selected.

After your software is set up, you will need to monitor your account and make sure that your trades are executing as planned. If everything is going well, then you can sit back and watch your account grow. If not, then you may need to make some adjustments to your software or your trade parameters.

Managed and AI-powered forex trading accounts can be a great way to get started in forex trading. Just make sure to do your research and choose a reputable provider. And don't forget to monitor your account and make adjustments as needed.

Having said that….

You can join our Forex Managed account program and earn 1-2% profits daily. See for yourself by clicking the below link.

Have a great journey, and may you catch some big waves on your way to prosperity!

To see Ai Forex Trading for real, click here.

https://www.myfxbook.com/members/SankarGanesan/TradeFxP-trend-antitrend-day-trading/10404725

To read why you should be with us, click here

To open an account, click here.

To see our regulation certificate: click here.

To see our news with the IFMRRC: click here.

For claims, click here.

For the main site: click here.

For blogs and articles: click here.

Main Website: www.TradeFxP.com

admin

admin