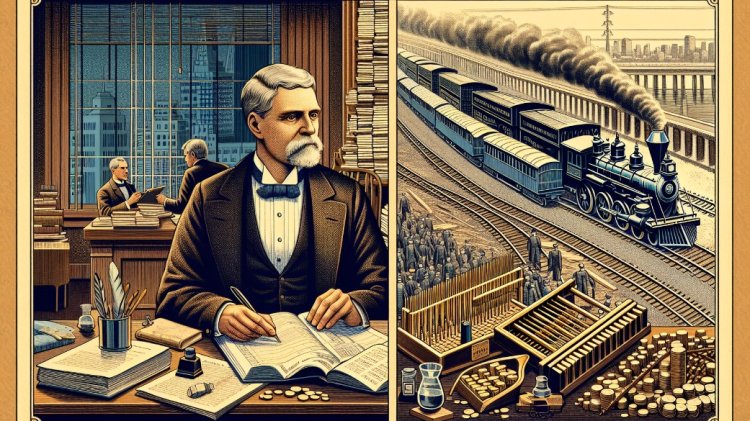

The Life and Legacy of JP Morgan: America's Most Powerful Financier

"Explore the extraordinary life and enduring legacy of J.P. Morgan, one of America's most influential financiers. This article takes you through his monumental contributions to the banking industry, his impact on the American economy, and how his legacy continues to shape modern finance."

Introduction

John Pierpont Morgan, known as J.P. Morgan, was a titan of American finance in the 1800s. His vast influence and wealth made him the most powerful man in the history of American finance. In this blog, we will explore the life and legacy of J.P. Morgan, delving into his upbringing, his career on Wall Street, and his significant contributions to the American economy.

Before we dive into the details, it's important to understand the context of Morgan's era. During the 1800s, America was an emerging market, heavily dependent on British capital. Morgan's timing, genius, and connections allowed him to rise to power in a pivotal period of American history.

In this blog, we will cover various aspects of J.P. Morgan's life, including:

-

His family background and influential upbringing

-

His early career on Wall Street and the formation of his own company

-

His role in consolidating the railroad industry and his reputation as a powerful dealmaker

-

His involvement in bailing out the United States government during economic crises

-

His legacy and the impact he had on American finance

Join us as we delve into the life and legacy of J.P. Morgan, exploring the fascinating story of America's most powerful financier.

Early Life and Influences

To understand the upbringing and influences that shaped J.P. Morgan into the most powerful man in American finance, it is important to look at his family background and the influential figures in his life.

Family background and influential figures

John Pierpont Morgan, or J.P. Morgan, was born into a privileged life on April 17th, 1837. His family background played a significant role in his upbringing and future success. His grandfather, John Pierpont, was a radical preacher who introduced young Pierpont to the power of forceful speaking. This skill would later benefit him greatly as a captain of industry.

However, the most influential figure in Morgan's life was his father, Junius Spencer Morgan. Junius was a highly respected businessman in both the American and European banking industries. He took it upon himself to shape his son into his own image, grooming him to eventually join the family banking business. Junius had a significant impact on Pierpont's upbringing and instilled in him the values and principles that would guide him throughout his career.

Impact of his father's guidance and tough love

The relationship between Pierpont and his father can be described as "tough love." Junius expected nothing but the best from his son and pushed him to excel in the banking industry. He mentored Pierpont, teaching him the ins and outs of the business world and helping him cultivate his promising potential for the future. Pierpont's leadership skills caught his father's eye, and Junius saw in him the makings of a successful businessman.

Although their relationship was sometimes challenging, Junius's guidance and tough love ultimately helped shape Pierpont into the influential financier he became.

Health challenges and their impact on his upbringing

Pierpont faced various health challenges throughout his upbringing, which had a significant impact on his upbringing and personality. He had rheumatic fever, scarlet fever, and excruciating migraines as a child in addition to suffering from seizures. However, his most visible medical complication was his acne rosacea, which severely affected the blood vessels in his nose.

These health challenges forced Pierpont to lead a more isolated childhood, as he was unable to play outside like other children. Instead, he spent his time studying and learning to read financial statements. Despite these setbacks, Pierpont's isolation allowed him to develop a keen interest in financial matters and hone his analytical skills.

Additionally, Pierpont's isolation led him to find solace in playing solitaire, a pastime that would become one of his lifelong pleasures.

Overall, Pierpont's early life and influences, including his family background, his father's guidance, and his health challenges, played a crucial role in shaping him into the powerful financier he would become.

Career Beginnings on Wall Street

John Pierpont Morgan, known as J.P. Morgan, began his career in the banking industry in the 1860s. With the help of his influential father, Junius Spencer Morgan, J.P. Morgan secured a starting position as an unpaid clerk in a small banking firm in New York.

One of Morgan's key responsibilities was providing overseas intelligence to his father, who was based in London. Twice a week, Morgan would write lengthy letters to his father, updating him on the latest American economic and political developments. Junius placed a high value on these letters and they were essential in helping him make financial decisions.

In 1861, Morgan took a significant step in his career by establishing his own company, J. Pierpont Morgan & Company. With his newfound independence, Morgan gained valuable firsthand experience in the business world, honing his skills as a banker and dealmaker.

As Morgan's reputation grew, he became known for his ability to consolidate industries, particularly the railroad industry. He would actively participate in the corporate management of the railroads he invested in, reshuffling leadership and directing the companies according to his vision.

Morgan's expertise and success in consolidating industries earned him a reputation as a powerful dealmaker and earned his company lucrative commissions. He used his influence and financial wizardry to stabilise the rail industry during times of crisis, contributing to the growth and development of the American economy.

Morgan participated in several significant financial transactions during his time on Wall Street, including the purchase of Carnegie Steel from Andrew Carnegie, which resulted in the establishment of the United States Steel Corporation, the first billion-dollar business in history.

Despite his immense success, Morgan faced criticism for the amount of power he held and his influence over the American economy. He appeared before the Pujo Committee in 1912, which investigated the financial power of a select group of bankers, including Morgan. While not found guilty of any illegal actions, the committee's findings led to the establishment of the Federal Reserve and income taxes.

Morgan's career beginnings on Wall Street laid the foundation for his rise to become one of the most powerful and influential figures in American finance. His expertise, dealmaking skills, and ability to consolidate industries cemented his legacy as a titan of American finance.

Morganization and Consolidation

John Pierpont Morgan, known as J.P. Morgan, was not only a powerful financier but also a master of consolidation. In particular, he focused on consolidating businesses in the railroad industry, where he saw the opportunity to bring order and stability to a chaotic market.

Morgan's Approach to Consolidating Businesses

Instead of simply owning stock in railroad companies, Morgan took an active role in the corporate management of the railroads he invested in. He would join the board of directors and use his influence to reshape the leadership and direction of the company. This practice, later known as "morganization," allowed Morgan to bring together competing railroads and create a more efficient and profitable industry.

Morgan's expertise in consolidating industries earned him a reputation as a powerful dealmaker. His ability to restructure companies and direct them according to his vision made him a formidable force in the business world.

Creation of U.S. Steel and United States Steel Corporation

One of Morgan's most significant consolidations was the creation of U.S. Steel, which became the world's first billion-dollar company. Morgan acquired Andrew Carnegie's Carnegie Steel and merged it with several other steel companies to form the United States Steel Corporation.

With this consolidation, Morgan not only controlled a significant portion of the steel industry but also had a major influence over the American economy. His ability to bring together large corporations and shape their operations made him a central figure in the country's industrial growth.

However, Morgan's consolidation efforts and the amount of power he held did not come without criticism. He faced scrutiny from government regulators and was even called to testify before the Pujo Committee in 1912, which investigated the financial power of a select group of bankers, including Morgan. While he was not found guilty of any illegal actions, the committee's findings led to the establishment of the Federal Reserve and income taxes.

Morgan's capacity to merge businesses and reshape industries served as a defining characteristic of his career. His reputation as a powerful dealmaker and his knack for bringing together competing companies solidified his legacy as one of the most influential figures in American finance.

Morgan's Influence and Power

John Pierpont Morgan, known as J.P. Morgan, was a powerful and influential figure in American finance during the late 1800s and early 1900s. However, his immense influence and power were not without criticism and scrutiny. Here are some key points regarding Morgan's influence and power:

Criticism and Scrutiny of Morgan's Influence on the Economy

Morgan's vast wealth and control over major industries, such as railroads and steel, led to concerns about his influence over the American economy. Many criticised him for having too much power and believed that he held a monopoly over certain sectors.

The Pujo Committee, formed in 1912 to investigate financial power in America, revealed that Morgan controlled over $22 billion of capital through his various corporations and directorships. While not found guilty of any illegal actions, the committee's findings led to the establishment of the Federal Reserve and income taxes as measures to regulate the concentration of power.

Relationship with President Roosevelt and Conflict over Anti-Monopoly Measures

President Theodore Roosevelt was known for his anti-monopoly stance and believed that large corporations, including Morgan's, needed to be regulated. Roosevelt saw Morgan's immense wealth and influence as a threat to the American economy and the principles of fair competition.

The conflict between Morgan and Roosevelt came to a head in 1901 when Morgan acquired Andrew Carnegie's steel company, forming the United States Steel Corporation, the first billion-dollar company. Roosevelt saw this consolidation as a dangerous concentration of power and initiated legal action against Morgan under the Sherman Anti-Trust Act of 1890. The Supreme Court eventually ordered the breakup of Morgan's Northern Securities Company in 1904.

Role in Bailing out the US Government during Financial Crises

Morgan's influence and power extended beyond the corporate world. During the Panic of 1893 and the Financial Crisis of 1907, the US government turned to Morgan for assistance in stabilising the economy.

In 1893, Morgan helped restore America's gold reserves by organising a syndicate of US and European investors to invest gold back into the government's coffers. In 1907, he played a pivotal role in bailing out failing banks and preventing a widespread economic depression. His reputation as a financial saviour earned him the title of hero, although he also profited from these interventions.

While Morgan's role in bailing out the government was seen as necessary at the time, it also raised concerns about the concentration of power in the hands of a private individual. These events, along with the Pujo Committee's investigation, led to calls for increased government regulations and oversight of the financial industry.

In conclusion, J.P. Morgan's influence and power over the American economy drew both admiration and criticism. His control over major industries and his role in bailing out the US government during financial crises solidified his reputation as one of the most powerful and influential figures in American finance. However, his immense wealth and concentration of power raised concerns about the lack of regulation and the potential for abuse.

Legacy and Final Years

John Pierpont Morgan, known as J.P. Morgan, left a lasting impact on the art world and American finance. During his lifetime, Morgan amassed a vast collection of valuable artwork, including pieces by renowned artists such as Leonardo da Vinci and Napoleon's personal possessions. Many of these artefacts were gifts to the Metropolitan Museum of Art after his passing, where they are still on display today. Morgan's contributions to the art world solidify his legacy as a patron of the arts and a lover of culture.

However, Morgan's final years were characterised by personal struggles and mental health issues. Throughout his life, he faced periods of nervous breakdowns and anxiety, exacerbated by the immense pressure and responsibility that came with his position as a powerful financier. His health issues and the negative public perception of him as a greedy businessman took a toll on his mental well-being.

Despite the controversies surrounding his influence and power, Morgan's impact on American finance cannot be denied. He played a pivotal role in stabilising the economy during financial crises, such as the Panic of 1893 and the Financial Crisis of 1907. His ability to rally the nation's top bankers and negotiate solutions to ensure economic stability earned him the reputation of a financial saviour.

Assessing Morgan's legacy is a complex task. While he is revered for his financial achievements and his contributions to the art world, his concentration of wealth and influence raised concerns about the lack of regulation and the potential for abuse. His involvement in monopolistic practices and his control over major industries led to government scrutiny and calls for increased regulations and oversight.

Ultimately, Morgan's legacy reflects the complex nature of his character and the impact he had on American finance. He was both admired and criticised for his immense power and influence. His contributions to the art world and his role in stabilising the economy during times of crisis cemented his place in history as one of America's most powerful and controversial financiers.

Conclusion

Reflecting on the life and legacy of J.P. Morgan, it is clear that he was a titan of American finance and one of the most powerful figures in the history of the industry. Morgan's journey was characterised by his tenacity, intelligence, and capacity to merge industries, from his upbringing and prominent family background to his beginnings on Wall Street.

Morgan's achievements and contributions offer several lessons that we can learn from:

-

Importance of mentorship and guidance: Morgan's father played a significant role in shaping his character and instilling in him the values that guided his career.

-

Perseverance in the face of challenges: Despite his health issues and personal struggles, Morgan remained focused on his goals and continued to make significant contributions to American finance.

-

Understanding the power of influence: Morgan's ability to consolidate industries and reshape them according to his vision solidified his reputation as a powerful dealmaker.

-

Responsibility in times of crisis: Morgan's involvement in bailing out the United States government during economic crises demonstrated his sense of responsibility and commitment to stabilising the economy.

-

The need for regulation and oversight: Morgan's concentration of power and influence raised concerns about the lack of regulation and the potential for abuse. This led to the establishment of government regulations and oversight bodies, such as the Federal Reserve.

J.P. Morgan's life and legacy hold valuable lessons for us all. His achievements and impact on American finance cannot be denied, but his immense wealth and power raise important questions about the balance between individual influence and the need for regulation. As we navigate the complexities of the modern financial world, it is essential to reflect on the lessons learned from Morgan's life and strive for responsible and ethical practices in finance.

For further information on J.P. Morgan, we recommend reading Ron Chernow's book, "The House of Morgan."

admin

admin