Understanding the Creation of Money: A Deep Dive into the Monetary System

Demystify the Magic of Money Creation! Dive deep into the fascinating world of the monetary system, exploring its evolution, key players, and the intricate processes that bring currency to life. Unravel the secrets of fractional reserve banking, central bank operations, and the impact of monetary policy on our everyday lives.

Introduction

Understanding how money is created is crucial for anyone looking to navigate the complex world of finance. The monetary system, which governs the creation and flow of money, plays a significant role in both national and international economies. It is essential to have an open dialogue and honest discussion about the future of the monetary system, especially in the wake of economic crises.

The impact of economic crises, like tumours, can grow if not properly addressed. Waiting for the crisis to pass is not a viable solution. It is important to be prepared and proactive in managing economic challenges. Trusting the government to solve these problems is often misguided, as the true power lies in the hands of influential private entities, such as Goldman Sachs.

It is obvious that the general public does not understand the current monetary system very well. Many people believe that banks simply hold and safeguard their deposits, unaware that banks actually create the majority of the money supply through lending. This lack of understanding extends to economists and policymakers, hindering their ability to effectively manage the economy.

Furthermore, the current system allows banks to create money out of thin air, leading to excessive debt and financial instability. The reliance on debt for economic growth perpetuates a cycle of borrowing and lending that can lead to recessions and economic collapses.

In order to have a healthy and sustainable economy, it is necessary to separate the creation of money from the banking system. This would allow for democratic control over the allocation of money and a more stable financial system. It is time for a transparent and informed discussion about the monetary system and its impact on society.

The Creation of Money

Understanding the creation of money is essential to grasping the complexities of the financial world. The monetary system, which governs the flow and creation of money, plays a critical role in both national and international economies. It is important to have an open and honest discussion about the future of the monetary system, especially in light of economic crises.

The creation of money is a complex process that involves various entities. The primary role in creating money lies with commercial banks. Contrary to popular belief, banks do not simply hold and safeguard deposits; they create the majority of the money supply through lending. This lack of understanding extends to economists and policymakers, hindering their ability to effectively manage the economy.

Commercial bank money is distinct from that of the central bank. Central banks, such as the Bank of England, have the authority to create central bank money, commonly known as base money. This includes physical currency, such as coins and banknotes, as well as electronic reserves held by commercial banks at the central bank. Commercial banks, on the other hand, create bank-created money, also known as commercial bank money, through the issuance of loans.

One concept related to the creation of money is seigniorage. The profit the government makes when it issues currency is known as seigniorage. When a central bank creates physical currency, such as banknotes, the cost of production is significantly lower than the face value of the currency. The difference between the cost of production and the face value is seigniorage, which goes directly to the government. Seigniorage reduces the need for higher taxes and can contribute to reducing the national debt.

The Role of Commercial Banks

Commercial banks play a dominant role in the creation of money within the monetary system. Contrary to popular belief, banks do not simply hold and safeguard deposits; they create the majority of the money supply through lending.

This dominance of commercial banks in money creation has significant implications for the economy. Central bank money is distinct from the money that banks create, also known as bank-created money or commercial bank money. Central banks, like the Bank of England, have the authority to create base money, which includes physical currency and electronic reserves held by commercial banks. However, commercial banks create money through the issuance of loans.

This issue of debt-based money creation has raised concerns about financial instability. When banks create money out of thin air through lending, it leads to excessive debt and a reliance on borrowing and lending for economic growth. This perpetuates a cycle that can ultimately result in recessions and economic collapses.

Furthermore, the role of interest in the banking system cannot be overlooked. Interest is the cost of borrowing money, and it is a fundamental aspect of the banking system. Banks make a profit by charging interest on the loans they provide. This interest acts as an incentive for banks to lend money and create more debt-based money.

In conclusion, commercial banks play a crucial role in the creation of money within the monetary system. Their dominance in money creation, the impact of bank-created money on the economy, the issue of debt-based money creation, and the role of interest in the banking system are all significant factors that shape the financial landscape.

The Monopoly of Central Banks

Central banks have a significant monopoly over the creation and control of money in the monetary system. This control allows them to impact the money supply and influence the economy in various ways.

The control of central banks over the money supply

Central banks have the authority to create or destroy central bank money, which includes physical currency and electronic reserves held by commercial banks. This control over the money supply gives central banks the power to regulate the economy.

The importance of reserves and central bank currency

Reserves and central bank currency play a crucial role in the monetary system. Reserves are funds held by commercial banks at the central bank that are used to settle interbank transactions. Central bank currency, such as coins and banknotes, is the most widely recognised form of money and is crucial for everyday transactions.

The role of central bank money in interbank transactions

Central bank money is essential for interbank transactions, as it provides a safe and secure means of settling payments between banks. This ensures the smooth functioning of the financial system and helps maintain stability in the economy.

The impact of central bank policies on the economy

Central bank policies, such as monetary policy and interest rate adjustments, have a direct impact on the economy. By controlling the money supply and interest rates, central banks can influence borrowing costs, investment levels, and inflation rates. These policies play a crucial role in managing economic growth and stability.

Overall, central banks hold a monopoly over the creation and control of money, which gives them significant power to manage the economy. Understanding their role and the impact of their policies is crucial for navigating the complex world of finance.

History of Money

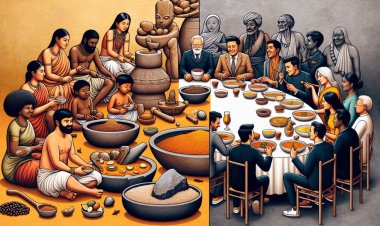

The evolution of money has a long and complex history that dates back to ancient civilizations. Throughout time, various forms of money have emerged and evolved to meet the needs of societies. Here is an overview of the key milestones in the history of money:

-

Barter System: In early civilizations, people would exchange goods and services directly without the use of money. This system, known as the barter system, relied on the mutual agreement of parties involved in a trade.

-

Commodity Money: As societies grew, the use of commodity money emerged. Commodity money is a type of money that has intrinsic value, such as gold, silver, or other valuable materials. These items were used as a medium of exchange in trade transactions.

-

Coinage: The development of coinage marked a significant advancement in the history of money. Coins were made from valuable metals and were standardised in weight and size. This made trade and commerce more efficient and reliable.

-

Banknotes: In the 17th century, the use of banknotes became widespread. Banknotes represent a promise by a bank to pay the bearer a specific amount of gold or silver upon demand. This allowed for the expansion of trade and facilitated the growth of economies.

-

Fiat Money: With the rise of central banks, the transition from gold-backed currencies to fiat money occurred. The trust and confidence of the people who use it serve as the backing for fiat money, which lacks a physical backing.

-

Bretton Woods System: After World War II, the international monetary system was established under the Bretton Woods agreement. This system fixed exchange rates for the US dollar, which was still tied to gold. It aimed to promote stability and facilitate international trade.

-

Collapse of the Bretton Woods System: In the 1970s, the Bretton Woods system collapsed due to economic pressures. The US dollar was no longer convertible to gold, and exchange rates became more flexible.

-

Rise of Fiat Currencies: Today, fiat currencies, such as the US dollar, the euro, and the British pound, dominate the global economy. These currencies derive their value from the trust and confidence of the people using them.

The history of money reflects the continuous evolution of human societies and their needs for a reliable and efficient medium of exchange. From barter systems to fiat currencies, money has played a pivotal role in shaping economies and societies throughout time.

Understanding the history of money allows us to appreciate the importance of trust and confidence in the monetary system and the role it continues to play in our lives.

Challenges and Criticisms

The monetary system, while crucial for the functioning of our economy, is not without its challenges and criticisms. These issues must be addressed in order to ensure a stable and sustainable financial system.

The inherent instability of the monetary system

One major challenge of the monetary system is its inherent instability. Economic crises, like tumours, can grow if not properly addressed. Waiting for the crisis to pass is not a viable solution. It is important to be prepared and proactive in managing economic challenges.

The impact of money creation on inflation and recession

Money creation has a direct impact on inflation and the recession. When banks create money out of thin air through lending, it can lead to excessive debt and inflationary pressures. On the other hand, during economic downturns, the lack of money creation can exacerbate recessions and economic collapses.

The issue of excessive debt and its consequences

The reliance on debt for economic growth perpetuates a cycle of borrowing and lending that can lead to excessive debt levels. This can have serious consequences for individuals, businesses, and even entire economies. High levels of debt can restrict economic activity and hinder long-term growth.

The need for democratic control over the creation of money

One of the criticisms of the current monetary system is the lack of democratic control over money creation. The majority of the money supply is created by commercial banks, with little oversight or regulation. This concentration of power in private entities raises concerns about financial stability and economic inequality.

In order to address these challenges and criticisms, it is necessary to have a transparent and informed discussion about the monetary system. Democratic control over money creation, along with effective regulation and oversight, can help ensure a more stable and equitable financial system.

Building a Sustainable Monetary System

Reforming the monetary system is crucial for creating a sustainable and stable economy. The current system, with its reliance on debt-based money creation by commercial banks, has led to excessive debt, financial instability, and economic crises. It is essential to explore alternative models that prioritise democratic control over money creation and separate it from the banking system.

The Need for Reform in the Monetary System

The general public, economists, and policymakers are unable to effectively manage the economy because of their lack of understanding of the current monetary system. The reliance on debt for economic growth perpetuates a cycle of borrowing and lending that can lead to recessions and economic collapses. Moreover, the concentration of power in private entities raises concerns about financial stability and economic inequality.

Separation of Money Creation from Banking

In order to create a sustainable monetary system, it is necessary to separate the creation of money from the banking system. This would prevent banks from creating money out of thin air through lending and reduce their reliance on debt for economic growth. By separating money creation from banking, it would be possible to have more control and oversight over the allocation of money.

The Importance of Democratic Control Over Money Creation

One of the criticisms of the current monetary system is the lack of democratic control over money creation. The majority of the money supply is created by commercial banks, with little oversight or regulation. By allowing democratic control over money creation, it would be possible to prioritise the allocation of money towards social and environmental goals, such as healthcare, poverty reduction, and environmental protection.

Exploring alternative monetary models

In order to build a sustainable monetary system, it is important to explore alternative models. Some alternative monetary models include complementary currencies, such as local currencies and time banks, which can promote local economic development and social cohesion. Other models, such as central bank digital currencies, can provide greater financial inclusion and transparency.

In conclusion, building a sustainable monetary system requires reform and the exploration of alternative models. By separating money creation from banking and prioritising democratic control over money allocation, it would be possible to create a more stable and equitable financial system.

Conclusion

Understanding the monetary system and how money is created is essential for navigating the complex world of finance. In this blog, we have explored key points about the creation of money, the role of commercial banks, the monopoly of central banks, the history of money, and the challenges and criticisms of the current monetary system.

It is evident that policymakers, economists, and the general public do not fully understand the current monetary system. Many people believe that banks simply hold and safeguard their deposits, unaware that banks actually create the majority of the money supply through lending. This lack of understanding hinders our ability to effectively manage the economy.

There is a need for further research and discussion on the monetary system, its impact on society, and the alternatives that exist. We need to have a transparent and informed dialogue about the creation of money and its allocation, as well as the role of banks and central banks in the process.

It is important to recognise the importance of understanding the monetary system and the impact it has on our daily lives. By separating the creation of money from the banking system and prioritising democratic control over its allocation, we can work towards building a more sustainable and equitable financial system.

Therefore, it is vital to take action and advocate for monetary reform. By educating ourselves and others about the monetary system, we can contribute to a more informed and transparent discussion about its future. Together, we can work towards creating a monetary system that serves the needs of society and promotes financial stability.

FAQ

Common questions and misconceptions about money creation

1. How is money created?

Commercial banks are primarily responsible for creating money through lending. When banks provide loans, they create new money in the form of bank-created money or commercial bank money.

2. Do banks simply hold and safeguard deposits?

No, banks create the majority of the money supply through lending. The belief that banks only hold deposits is a common misconception.

Addressing concerns about the impact of money creation

1. Does money creation lead to excessive debt and inflation?

Money creation can lead to excessive debt and inflationary pressures. When banks create money through lending, it can result in a cycle of borrowing and lending that contributes to inflation and economic instability.

2. How does money creation affect economic recessions?

The reliance on debt-based money creation can exacerbate recessions and economic collapses. When banks stop lending, it can lead to a decrease in economic activity and further economic downturns.

Explaining the role of banks and central banks

1. What is the role of commercial banks in money creation?

Commercial banks play a dominant role in money creation by creating bank-created money through lending. They create the majority of the money supply.

2. What is the role of central banks?

Central banks have the authority to create or destroy central bank money, which includes physical currency and electronic reserves held by commercial banks. They regulate the money supply and influence the economy through monetary policy and interest rate adjustments.

Discussing potential solutions and alternatives

1. How can the current monetary system be reformed?

One potential solution is to separate the creation of money from the banking system. This would prevent banks from creating money through lending and reduce their reliance on debt for economic growth.

2. What is the importance of democratic control over money creation?

The lack of democratic control over money creation is a criticism of the current monetary system. Allowing democratic control over money creation would prioritise the allocation of money towards social and environmental goals.

admin

admin