Unveiling the Truth: Why Gold Controls the World

Discover "Why Gold controls the world"! Unearth the hidden truths & learn how this precious metal plays a pivotal role in the global economy.

Unveiling the Truth: Why Gold Controls the World

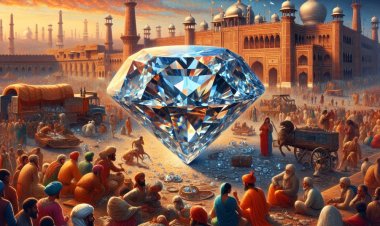

Have you ever wondered why gold holds such immense power and influence over the world? It's not just a shiny metal that people love to wear as jewellery. Gold has significance that goes beyond its physical appearance. It holds a very crucial place in our global economy and shapes the financial landscape in ways you might not have imagined.

The importance of gold cannot be overstated. It has played a vital role in human history and continues to wield its influence today. From ancient times when it was used as a currency to modern times when it is a symbol of wealth, gold's impact on the global economy is undeniable. It is a globally accepted asset that serves as a hedge against inflation and a safe haven in times of crisis.

So, why does gold control the world? What gives it the power to sway economic decisions and impact world markets? The answers to these questions and more lie in its global impact.

Key Takeaways:

- Gold holds immense power and influence over the world economy.

- It has played a vital role in shaping human history.

- Gold is a globally accepted asset that serves as a hedge against inflation and a safe haven in times of crisis.

- Its impact on the global economy is undeniable, and it continues to wield its influence today.

- The answers to why gold controls the world lie in its global impact.

The Historical Significance of Gold

You know what they say—history repeats itself. And it seems that gold has been repeating its dominance in the financial system for centuries.

Gold's influence on world markets is undeniable. This yellow metal has been shaping economies and dictating financial decisions for as long as we can remember. Gold's dominance in the financial system can be traced back to the ancient civilizations of Egypt, Greece, and Rome. These civilizations were the first to recognise the value of gold as a symbol of power and wealth.

Fast forward a few centuries, and gold continues to play a crucial role in shaping the global economy. The gold standard, which came into existence in the 1800s, made it possible to back currencies with gold. This ensured stability in the financial system and prevented inflation.

But gold's influence didn't stop there. In fact, during the 20th century, gold played a significant role in shaping the global economy. After World War II, the Bretton Woods Agreement established the US dollar as the world's reserve currency, with all other currencies being pegged to it. And what was the US dollar backed by? You guessed it—gold.

However, as we know, all good things must come to an end. In 1971, President Nixon ended the gold standard, leading to the rise of fiat currencies and the decline of gold's dominance in the financial system.

Despite this, gold still maintains its historical significance. It is a symbol of wealth and power, and its influence on world markets cannot be ignored. Gold's role in shaping economies and its ongoing dominance in the financial system are a testament to its historical significance.

The Historical Significance of Gold

Gold's Impact on Geopolitical Affairs

Ah, the politics of gold. It's no secret that gold has a significant impact on geopolitical affairs. You might be wondering how a shiny metal can affect global stability, but trust me, it does. Gold is not just an asset; it's a tool that can be used to influence political decisions and foster global stability.

Think of it this way: countries often hold gold reserves as a safeguard against economic turmoil. When a nation's currency is under threat, they can turn to gold as a safe haven asset. This can prevent economic collapse and maintain political stability.

“Gold is a hedge against the irresponsibility of governments.” - Richard DeVos

Furthermore, gold can be used as a diplomatic tool. When a country is in good standing with another, they may exchange gold as a symbol of their partnership. This can strengthen relationships and promote trust between nations.

On the flip side, gold can also be used as a weapon. Countries may manipulate the price of gold to harm their enemies financially. This tactic can have devastating effects on a nation's economy and destabilise their political system.

Overall, gold plays a crucial role in maintaining global stability and influencing political decisions. Its significance in geopolitical affairs cannot be underestimated.

The Economic Significance of Gold

So, you're curious about the value of gold and its impact on the global economy? Well, get ready for some fun facts and snarky comments.

First off, let's talk about the gold standard. No, it's not a standard for the perfect karat in your jewellery, although that would be nice. In the economic world, the gold standard refers to a monetary system where a country's currency is backed by a fixed amount of gold. It was widely used throughout the 19th and early 20th centuries until it was abandoned in the 1970s.

But why was gold chosen as the standard? Well, for one, it's rare and valuable. People have been obsessed with gold for centuries, from the ancient Egyptians who used it to adorn their pharaohs to the modern-day jewellery industry. Plus, gold doesn't corrode or tarnish, making it a reliable store of value.

But even though we've moved away from the gold standard, that doesn't mean gold has lost its economic significance. On the contrary, gold is still a major player in the global economy. Investors and economists alike closely monitor its value because shifts in gold prices can indicate changes in the market and the state of the economy as a whole.

So, how is gold valued? Well, it's a tricky process. There are a variety of factors that come into play, such as supply and demand, inflation, and global events like wars and political upheaval. But ultimately, the value of gold comes down to one thing: trust. Investors trust that gold will hold its value over time, even if other assets lose their worth.

And that trust is well-placed. Gold has proven to be a reliable store of value over the centuries, even in times of extreme economic turmoil. During the Great Recession of 2008, for example, gold prices soared as investors looked for a safe haven amid the chaos.

So, there you have it. The value of gold may not be based on a fixed standard anymore, but its economic significance is as strong as ever. And with its reliable store of value and global importance, we have a feeling gold will continue to play a major role in the world economy for years to come.

The Gold Market: Influencing World Indicators

Are you someone who likes to keep an eye on the stock market? Well, if you're not paying attention to the gold market, you're missing out on some serious insights into the world economy. Gold prices are one of the most reliable indicators of market volatility, and the gold industry plays a crucial role in the global marketplace.

Investing in gold can be a savvy move, especially during times of economic uncertainty. In fact, many investors turn to gold as a safe haven asset in times of crisis. And it's not just individual investors who are taking note. Central banks around the world are increasing their gold reserves, recognising their value as a stable and reliable asset.

But it's not just about investing. The gold industry also has a significant impact on global trade and commerce. Gold is used in a variety of industries, from electronics to healthcare, and its value can have far-reaching effects on various sectors.

So, next time you're checking the stock market, don't forget to keep an eye on the gold market, too. You never know what insights you might gain into the global economy and the world's financial landscape.

Gold as a Global Currency

Let's face it, when it comes to currency, gold takes the cake. Not only is it a universally accepted form of payment, but it also holds its value and is recognised as a safe haven asset in times of economic uncertainty. So, what makes gold so attractive as a currency?

For one, gold has a limited supply, which means it's less susceptible to inflation than other currencies. In fact, gold has maintained its value for centuries, which is why it's still a popular form of currency today. Additionally, gold's global influence cannot be ignored. It's used as a currency in many countries, including India, and is accepted worldwide.

But gold isn't just a form of payment. It's also seen as a safe haven asset, which means people tend to invest in it during times of economic turmoil. In fact, during the 2008 financial crisis, the price of gold surged as investors sought a safe place to store their wealth.

For those who are new to investing, gold is also considered a relatively low-risk asset. While its value can fluctuate, it is generally a stable investment that can provide a hedge against market volatility. And since gold is recognised worldwide, it can be easily traded on the global market.

So, whether you're looking to make a purchase or invest your money, gold is a currency that is both recognised and trusted worldwide. Its value and stability make it a sought-after asset, and its global influence means it's always in demand.

Gold in International Trade and Finance: Why It's the Global Standard

Are you aware of the importance of gold in international trade and finance? Let's delve into why it's the global standard.

Gold has been a valuable asset for centuries, and its significance has only grown in modern times. Its role in international trade and finance is vital, acting as a universal currency that transcends national borders and political systems.

As a global standard, gold serves as a reliable benchmark for currency exchange rates, providing an anchor for countries to stabilise their economies. It also helps reduce inflation, as central banks can regulate the supply of money by adjusting their gold reserves. Moreover, gold is used to settle international debts, as it's universally accepted and recognised as a valuable asset.

Gold's importance in international trade and finance goes beyond its monetary value. It helps maintain stability in the global financial system by providing a secure and stable investment option for individuals and institutions. As a result, gold's demand continues to increase, further solidifying its role as the global standard.

In conclusion, gold's importance in international trade and finance cannot be overstated. Its role as the global standard is essential to stabilising the global economy and maintaining financial stability. So, whether you're an investor, a central banker, or simply someone fascinated by economics, understanding gold's significance is crucial in today's interconnected world.

Gold's Role in Shaping Economic Policies

Let's face it, you're probably not a central banker or a financial policy expert. But that doesn't mean you can't understand the role that gold plays in shaping economic policies. In fact, gold's dominance in the global economy is nothing short of remarkable.

From being the basis of currencies to serving as a store of value, gold has been a driving force in shaping economic policies around the world. But why does it have such an impact on the economy? Well, for starters, gold has a limited supply and cannot be easily produced. This rarity makes it valuable and a sought-after commodity.

Add to that the fact that gold has been viewed as a symbol of wealth and prosperity for centuries, and it's easy to see why it has become so important in the financial world. Countries with large gold reserves have significant bargaining power and can influence economic decisions on a global scale.

Gold's dominance in the global economy has also led to the development of the gold standard, a monetary system where the value of a country's currency is linked to a fixed amount of gold. This system has now largely been abandoned, but it played a significant role in shaping global economic policies for centuries.

So, what does all of this mean for you? Well, it means that gold's role in shaping economic policies is not something to be taken lightly. The decisions made by central banks and governments regarding gold reserves and their use can have real-world impacts on everything from inflation to global trade.

As Mahatma Gandhi once said, "Gold is the supreme lord of material possessions." And he wasn't wrong.

In conclusion, gold's dominance in the global economy and its role in shaping economic policies cannot be overstated. Its rarity and symbolic value make it a valuable commodity for countries and investors alike. So, the next time you see headlines about fluctuations in gold prices, know that it's not just a matter of supply and demand; it's about the global power of gold.

Understanding Gold's Influence on World Markets

It's no secret that gold holds immense power in the world of finance. In fact, it is often said that the price of gold can dictate economic decisions.

As an investor, you're likely aware of the impact that gold prices can have on your portfolio. But did you know that changes in gold prices can also have far-reaching effects on various industries?

For instance, the price of gold has a significant impact on the mining industry. When gold prices are high, mining companies may increase production and exploration efforts, leading to job growth in these sectors. Conversely, when gold prices are low, mining operations may scale back, resulting in job losses.

Gold prices can also impact the value of currencies. When the price of gold rises, the value of currencies typically decreases as investors seek out safe-haven investments like gold. This can lead to changes in exchange rates and affect international trade.

Overall, the impact of gold on world markets cannot be understated. Its fluctuating prices can have a ripple effect on various sectors and industries, making it a crucial component of the global economy.

As famed investor Warren Buffet once said, "Gold gets dug out of the ground in Africa or someplace. Then we melt it down, dig another hole, bury it again, and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their heads." And yet, we continue to place such immense value on this precious metal.

So, the next time you see updates on gold prices, remember that it holds significant power in the world of finance and can even influence economic decisions.

Conclusion

Congratulations! You now have a better understanding of the global power of gold and its economic significance. From its historical significance to its impact on geopolitical affairs, the influence of gold stretches far and wide. As we've explored, gold's dominance in the financial system has remained steadfast throughout history. The gold market has a significant impact on world indicators, influencing everything from the price of oil to the value of currencies. Gold's role as a global currency and safe haven asset means it holds immense power in shaping economic policies. Its influence on world markets cannot be underestimated, with fluctuations in gold prices having far-reaching effects on various industries. In conclusion, the importance of gold in international trade and finance cannot be overstated. Its global influence is a testament to its enduring value, and as we move forward, gold will continue to hold a significant place in our world's economic landscape.

FAQ

Why is gold considered to control the world?

Gold holds significant power and influence over the world due to its historical significance, economic value, and global dominance in the financial system.

What is the historical significance of gold?

Gold has played a crucial role in shaping economies and has maintained its influence on world markets throughout history.

How does gold impact geopolitical affairs?

Gold can influence political decisions and contribute to fostering global stability.

What is the economic significance of gold?

Gold has economic value and is closely tied to the global economy, with concepts like the gold standard impacting financial systems.

How does the gold market influence world indicators?

The gold market, including gold prices and investments, can have significant effects on various industries and global indicators.

What role does gold play as a global currency?

Gold is often considered a safe haven asset and holds global influence as a form of currency.

How important is gold in international trade and finance?

Gold acts as a global standard and plays a vital role in international trade and finance.

How does gold shape economic policies?

Gold's dominance in the global economy can influence economic decision-making and shape policies.

How does gold influence world markets?

Gold can dictate economic decisions and have a significant impact on world markets.

What is the conclusion regarding gold's global influence?

Gold holds immense power in shaping the world's financial landscape and has substantial economic significance.

TradeFxP Features

If you choose to be a self-employed retail trader, here are a few things we offer:

- The best trading Platform

- No Requotes

- Lowest Spreads

- High-level liquidity

- Interbank connectivity

- Pure STP/DMA/ECN

- Free signals

- Best support

- Crypto Wallet and withdrawals / Deposits (USDT)

- Robust CRM

- TradeFxP wallet

- Once click withdrawal

- Multiple payment options

- Local offices to walk in

- Free VPS

- Free Video Chat / Virtual Meetings

- And many more…

If you choose to be a part of our managed account program:

- All of the above +

- 1-2% Daily Profits

- High-level risk management

- Capital protection

- Only 30% of the capital used

- Negative balance protection

- Our fee is from the profits only

- Monthly profit withdrawal

- Wallet system – Use it like Phonepe, or Google Pay

- Crypto wallet and withdrawals / Deposits (USDT)

- Live monitoring

- MyFxbook Live monitoring

- Copy Trading

- And many more…

Optional: If you do not withdraw your profits for 2 months, our system will use those profits to trade and will keep your 100% capital safe and secure for margin purposes. This is optional, and if you choose not to be a part of it, you can withdraw your profits from the first month itself.

Why 1-2% daily? Can't your managed forex account earn more?

Yes, we can! Remember: greed may be good in the beginning, but in the end, it will destroy everything. You and I know that! Many droplets make an ocean! Join the Managed Account Program and sit back for six months, then look at your account. You'll see that our strategy is good and the best. Do you know what I mean?

If you choose to be a part of us as an introducing broker (IB) or channel partner,

- Industry best Rebates

- Local Office support

- Staff support

- Marketing support

- Marketing materials

- And many more…

Having said that….

You can join our Forex Managed Account program and earn 1-2% profits daily. See for yourself by clicking the below link.

Have a great journey, and may you catch some big waves on your way to prosperity!

To see Ai Forex Trading for real, use these credentials.

- Low-risk strategy:

- Mt4: 112018

- Pw: Allah@101

- Server: tradefxp live,

1. To read why you should be with us, click here.

2. To open an account, click here.

3. To see our regulation certificate, click here.

4. To see our news with the IFMRRC, click here.

5. For claims, click here.

6. For the main site, click here.

7. For blogs and articles, click here.

8. Main Website: www.TradeFxP.com

admin

admin